1040 Ez Printable

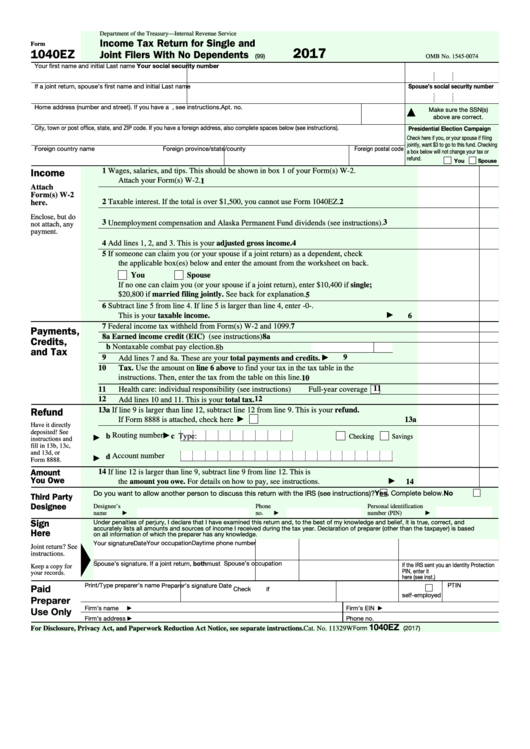

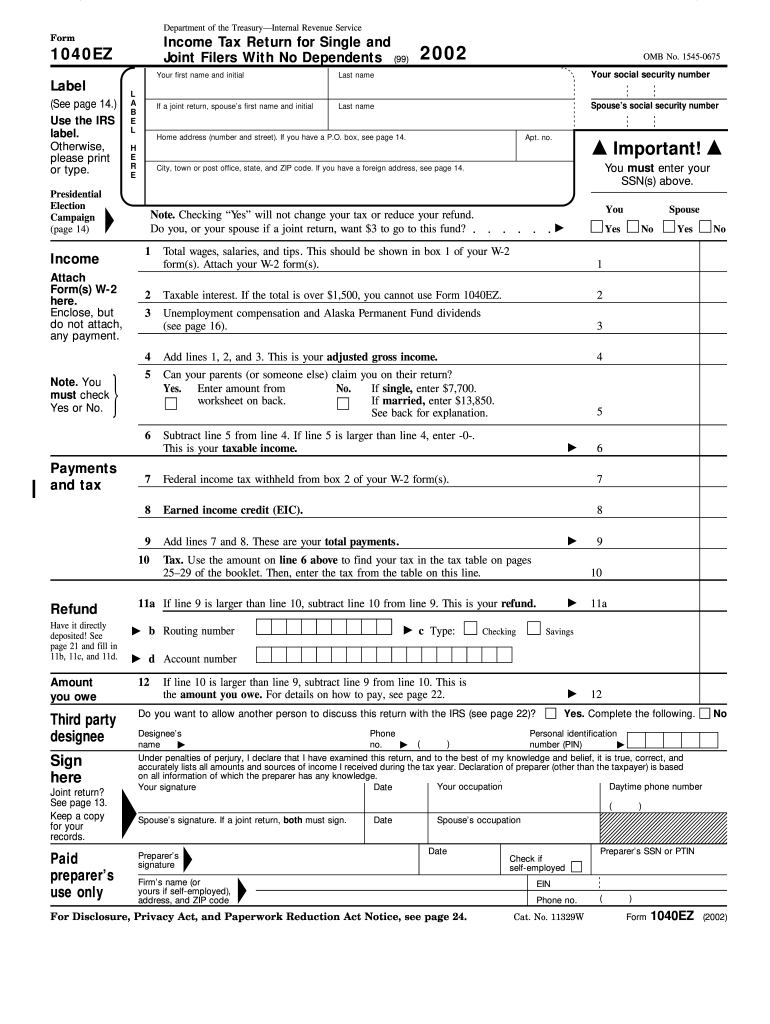

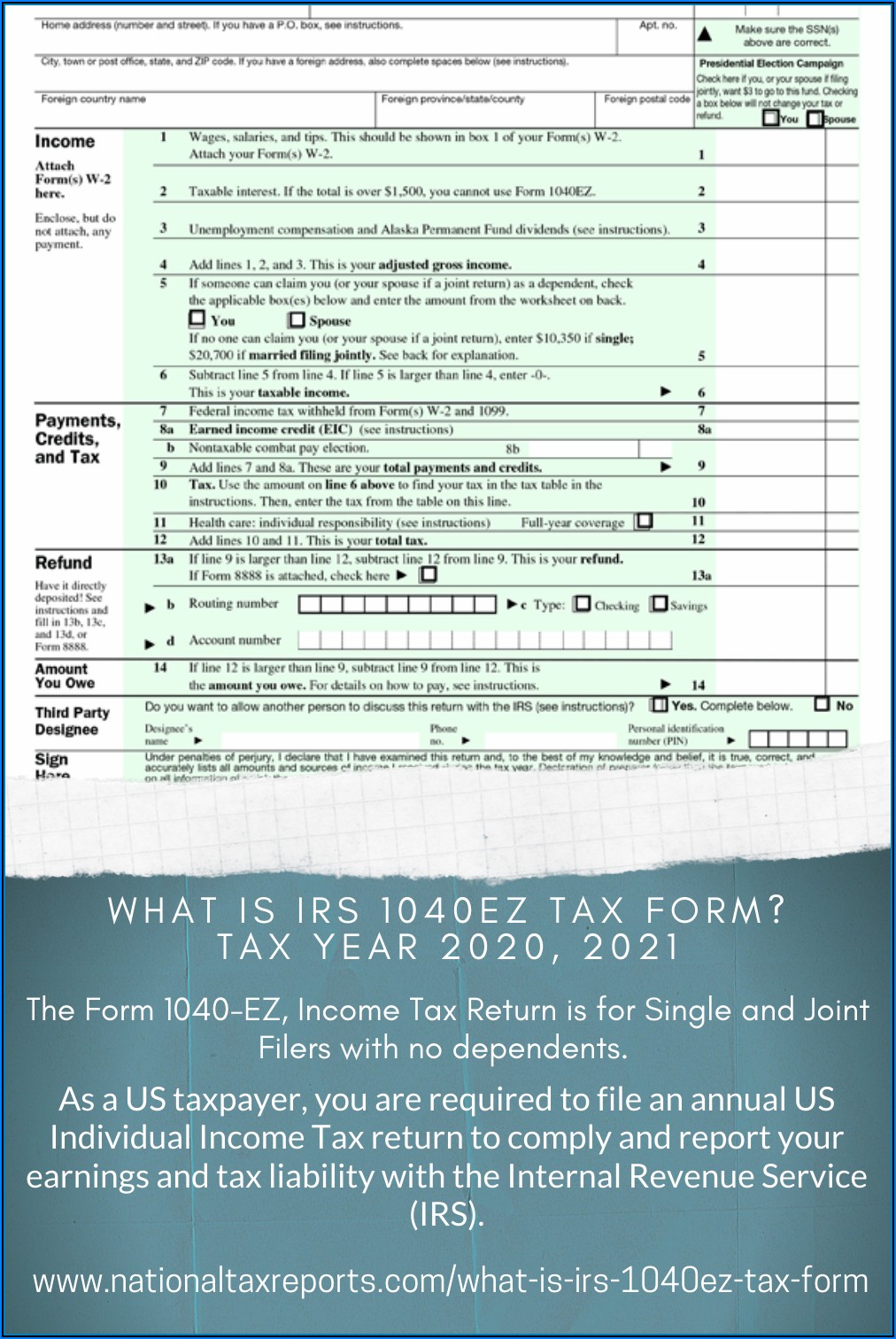

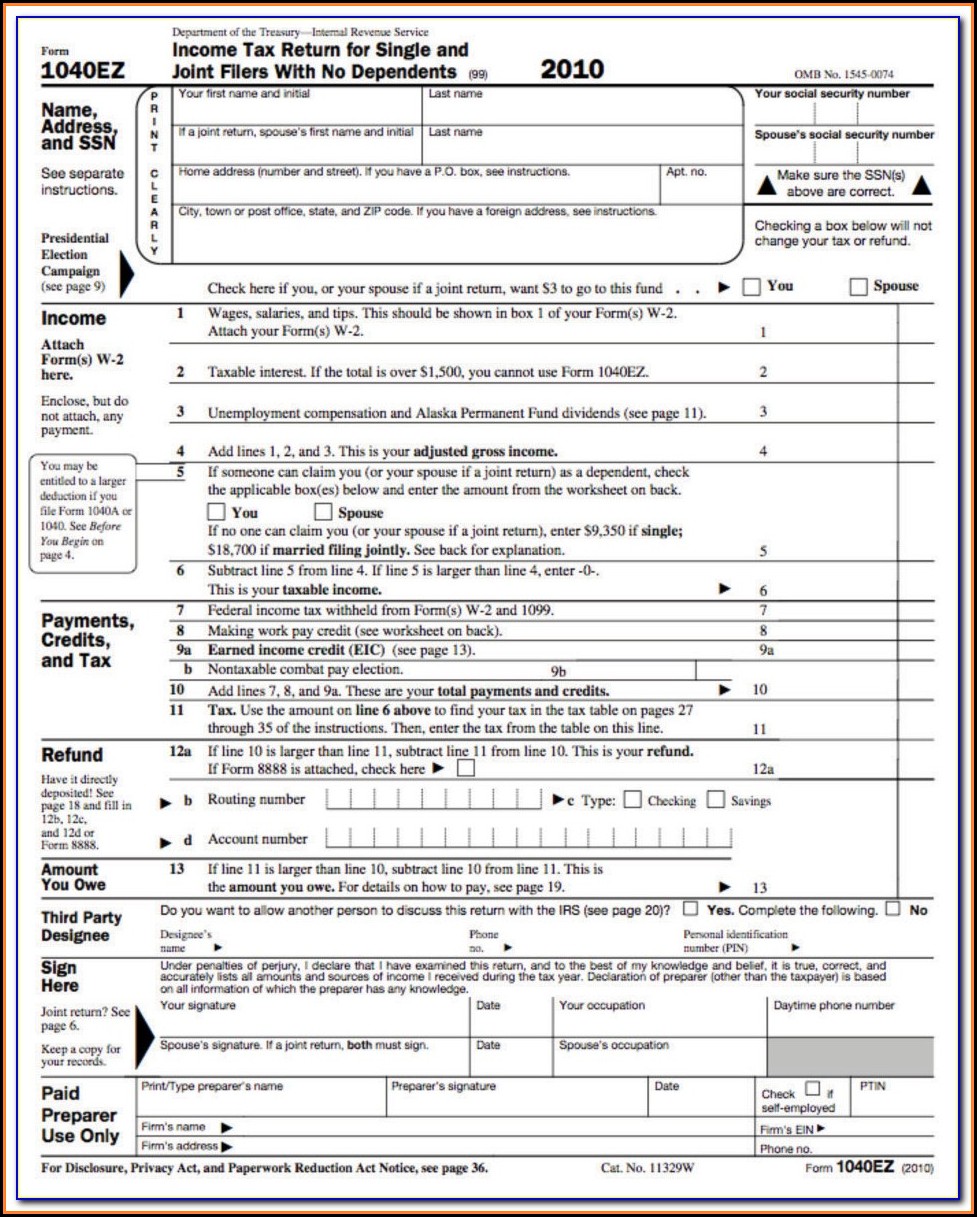

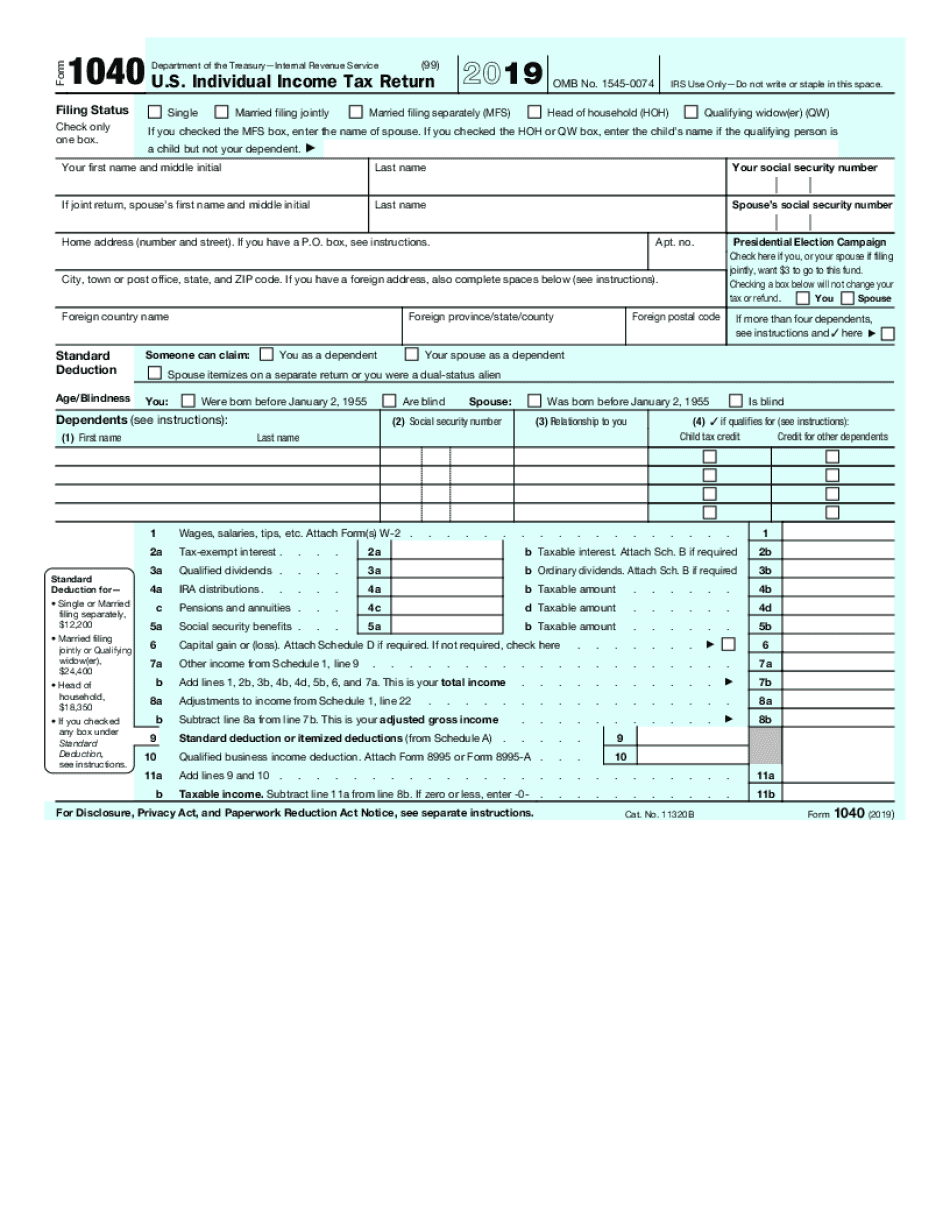

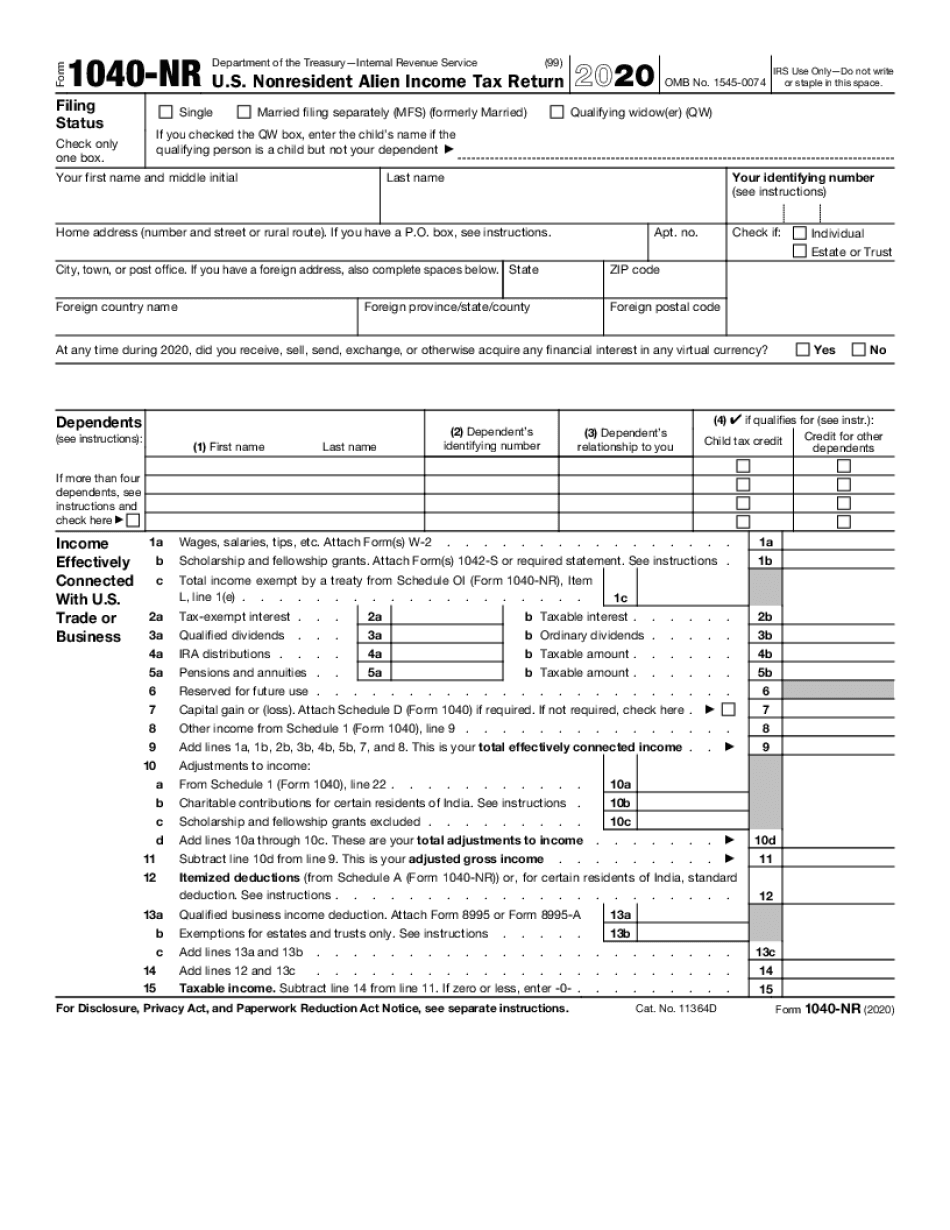

1040 Ez Printable - Web paying to file. It allowed single and joint filers with no. 1040 ez form printable who should use the 1040ez form? Web form 1040ez was a simplified version of the standard 1040 form that most americans use to file their taxes. In 2021, americans who claimed the standard deduction paid an average of $220 for. It is the simplest form available to use for filing your federal. Web how to file free file free file fillable forms choose the right 1040 form what's the right form 1040 for me? Web contents what is a 1040ez form and how do you use it? Web forms, instructions and publications search. Web 1 wages, salaries, and tips. 1040 ez form printable who should use the 1040ez form? Web get federal tax return forms and file by mail. Web what is an ez 1040? Web contents what is a 1040ez form and how do you use it? Web form 1040ez was a shortened version of form 1040 for taxpayers with basic tax situations. To open the printable 1040 ez form, you would need to click the fill out form button. It allowed single and joint filers with no. The 1040ez is a simplified form used by the irs for income taxpayers that do not require. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web how to file free. Web what is an ez 1040? Web form 1040ez was a simplified version of the standard 1040 form that most americans use to file their taxes. Web before recent tax reforms, you could file with form 1040ez if: Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web printable 2019 federal income tax forms 1040, 1040ss,. It is the simplest form available to use for filing your federal. Web what is an ez 1040? Web if you want to fill out the 1040 form correctly, you should first get the 2022 1040 tax form version. The 1040ez is a simplified form used by the irs for income taxpayers that do not require. 1040 ez form printable. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web form 1040ez was a shortened version of form 1040 for taxpayers with basic tax situations. Web printable form 1040ez. Web printable 2019 federal income tax forms. To start the document, utilize the fill & sign online button or tick the preview. Web open the document with our professional pdf editor. Web irs form 1040ez was a shortened version of the irs tax form 1040. Web get federal tax return forms and file by mail. Web if you want to fill out the 1040 form correctly, you. Web printable form 1040ez. Your filing status was single or married filing jointly. Fortunately, we’ve already taken the latest edition. Web how to file free file free file fillable forms choose the right 1040 form what's the right form 1040 for me? Web contents what is a 1040ez form and how do you use it? It allowed single and joint filers with no. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay. Web the way to complete the printable 1040ez online: Page last reviewed or updated: Fill out general personal information (first and last name,. Web what is an ez 1040? Web contents what is a 1040ez form and how do you use it? Web printable 2019 federal income tax forms 1040, 1040ss, 1040pr, 1040nr, 1040x, instructions, schedules, and more. It is the simplest form available to use for filing your federal. To open the printable 1040 ez form, you would need to click the. Web the way to complete the printable 1040ez online: Web open the document with our professional pdf editor. Web how to file free file free file fillable forms choose the right 1040 form what's the right form 1040 for me? Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web before recent tax reforms, you could. Web printable 2019 federal income tax forms 1040, 1040ss, 1040pr, 1040nr, 1040x, instructions, schedules, and more. Web open the document with our professional pdf editor. Your filing status was single or married filing jointly. Web the way to complete the printable 1040ez online: Web get federal tax return forms and file by mail. To start the document, utilize the fill & sign online button or tick the preview. Get paper copies of federal and state tax forms, their instructions, and the address. Web forms, instructions and publications search. Web printable form 1040ez. Web contents what is a 1040ez form and how do you use it? Page last reviewed or updated: Individual income tax return 2022 department of the treasury—internal revenue service omb no. To open the printable 1040 ez form, you would need to click the fill out form button. The 1040ez is a simplified form used by the irs for income taxpayers that do not require. Fortunately, we’ve already taken the latest edition. Web what is an ez 1040? Web before recent tax reforms, you could file with form 1040ez if: In 2021, americans who claimed the standard deduction paid an average of $220 for. Web irs form 1040ez was a shortened version of the irs tax form 1040. Web if you want to fill out the 1040 form correctly, you should first get the 2022 1040 tax form version. It is the simplest form available to use for filing your federal. It allowed single and joint filers with no. 1040 ez form printable who should use the 1040ez form? Web form 1040ez was a shortened version of form 1040 for taxpayers with basic tax situations. Web form 1040ez was a simplified version of the standard 1040 form that most americans use to file their taxes. To start the document, utilize the fill & sign online button or tick the preview. Web what is an ez 1040? Fill out general personal information (first and last name,. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay. Your filing status was single or married filing jointly. Web get federal tax return forms and file by mail. In 2021, americans who claimed the standard deduction paid an average of $220 for. Fortunately, we’ve already taken the latest edition. Web printable 2019 federal income tax forms 1040, 1040ss, 1040pr, 1040nr, 1040x, instructions, schedules, and more. Click any of the irs 1040ez form links below to download, save, view, and print the file for the corresponding year. Individual income tax return 2022 department of the treasury—internal revenue service omb no.1040ez 2022 pdf Fill Online, Printable, Fillable Blank 2016form

1040ez Forms Printable Universal Network

Fillable Form 1040Ez Tax Return For Single And Joint Filers

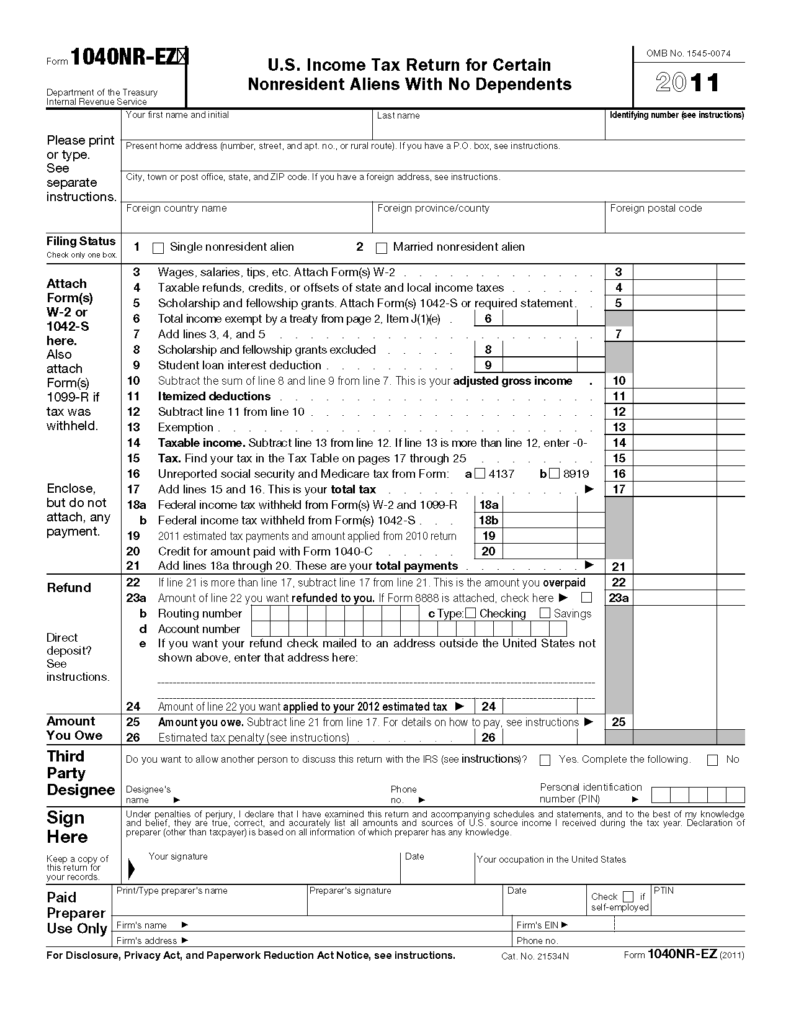

Form 1040 NR EZ U S Tax Return For Certain 1040 Form Printable

Printable 1040ez Form Fill Out and Sign Printable PDF Template signNow

1040ez Tax Form Form Resume Examples ABpV5eV1ZL

Printable Federal Tax Forms 1040ez Form Resume Examples e79Qn1gYkQ

form 1040ez 2018 Fill Online, Printable, Fillable Blank 2019form

Form 1040 Wikipedia

form 1040nrez Fill Online, Printable, Fillable Blank

Web How To File Free File Free File Fillable Forms Choose The Right 1040 Form What's The Right Form 1040 For Me?

Web Printable Form 1040Ez.

Web The Way To Complete The Printable 1040Ez Online:

Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address.

Related Post: