2019 Tax Forms 1040 Printable

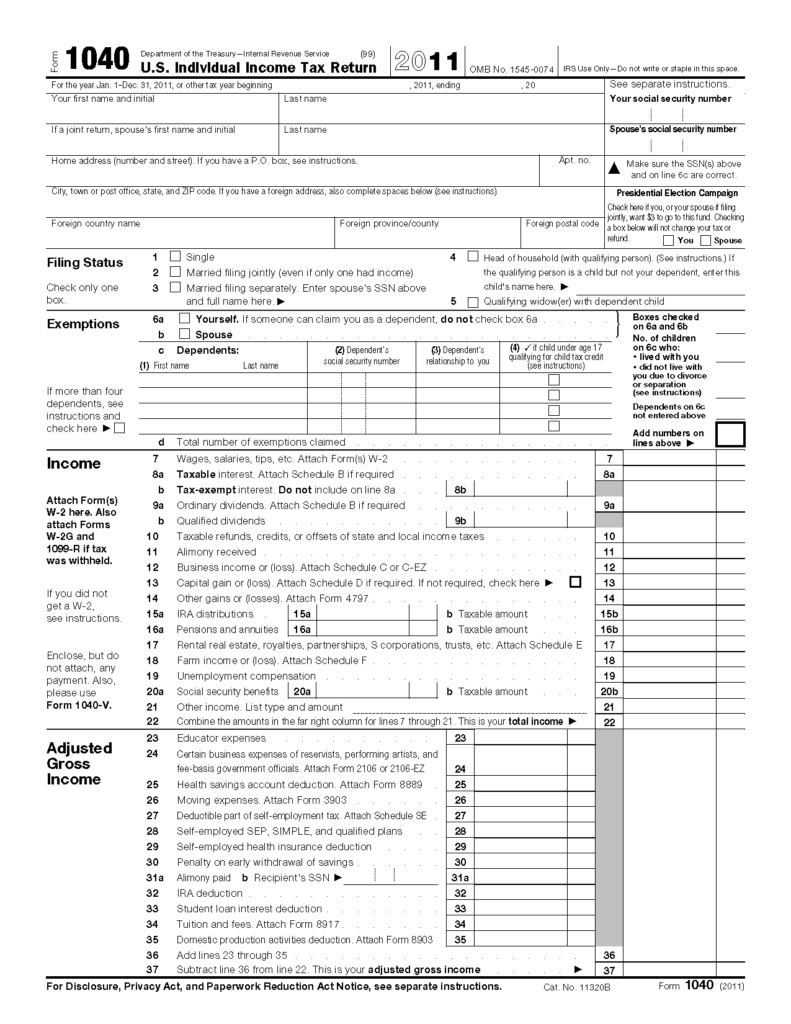

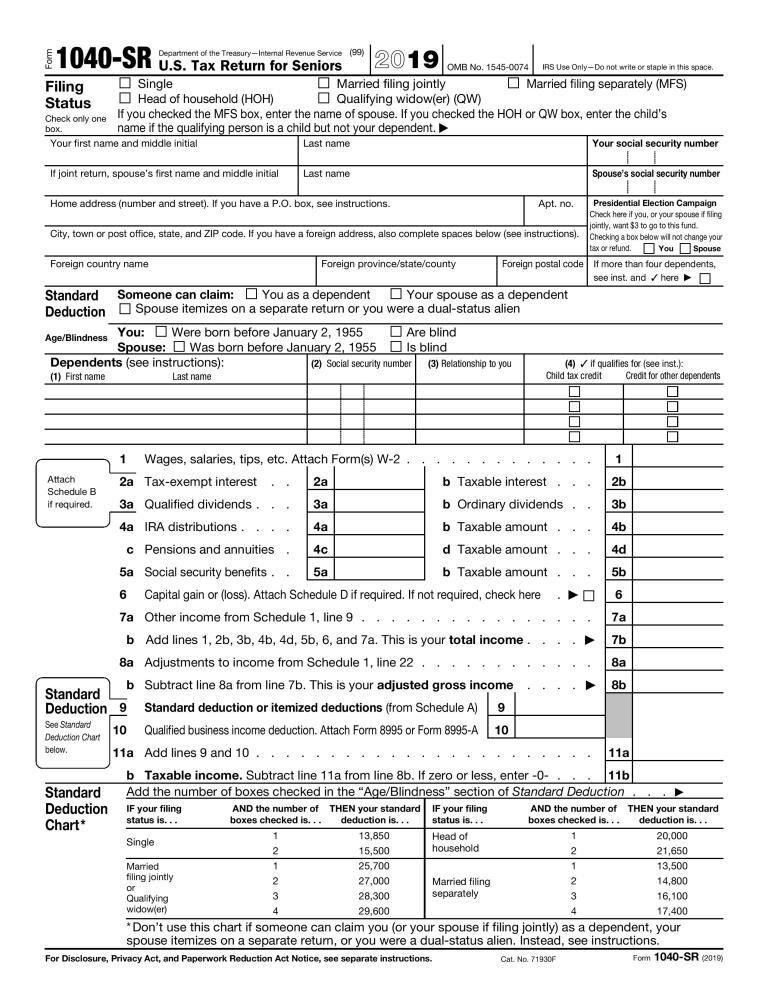

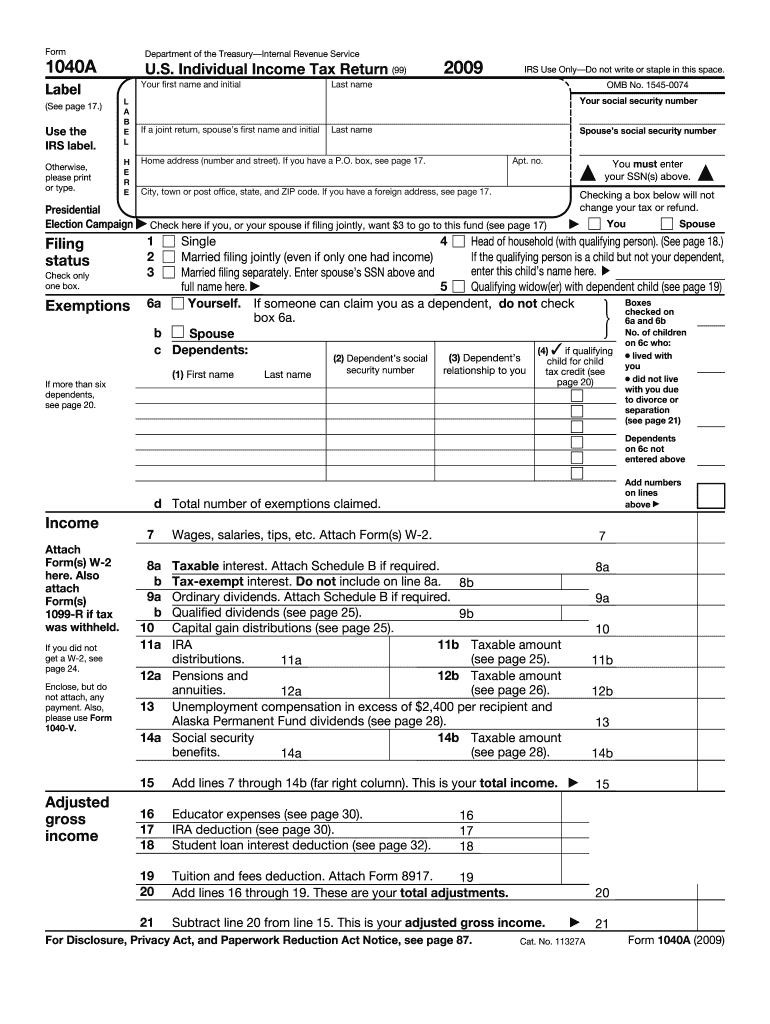

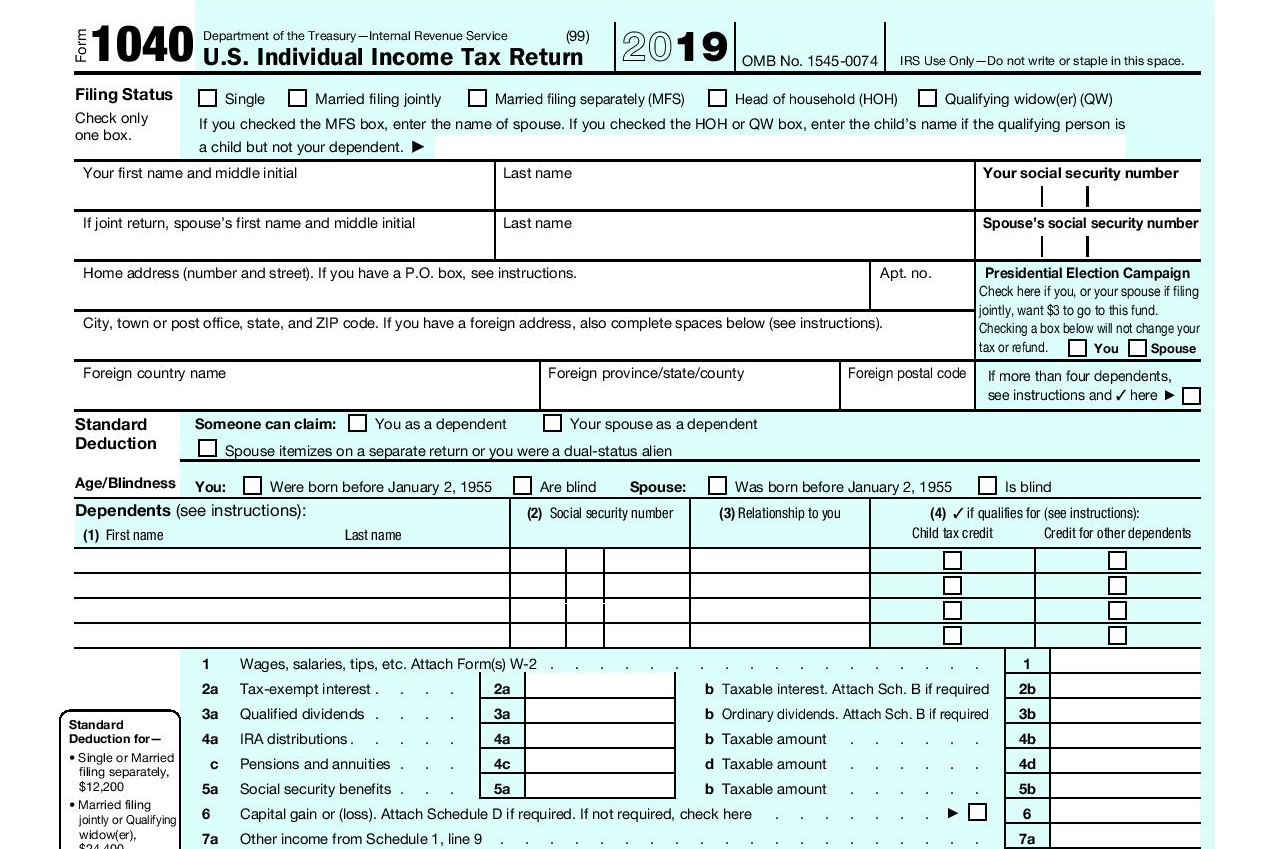

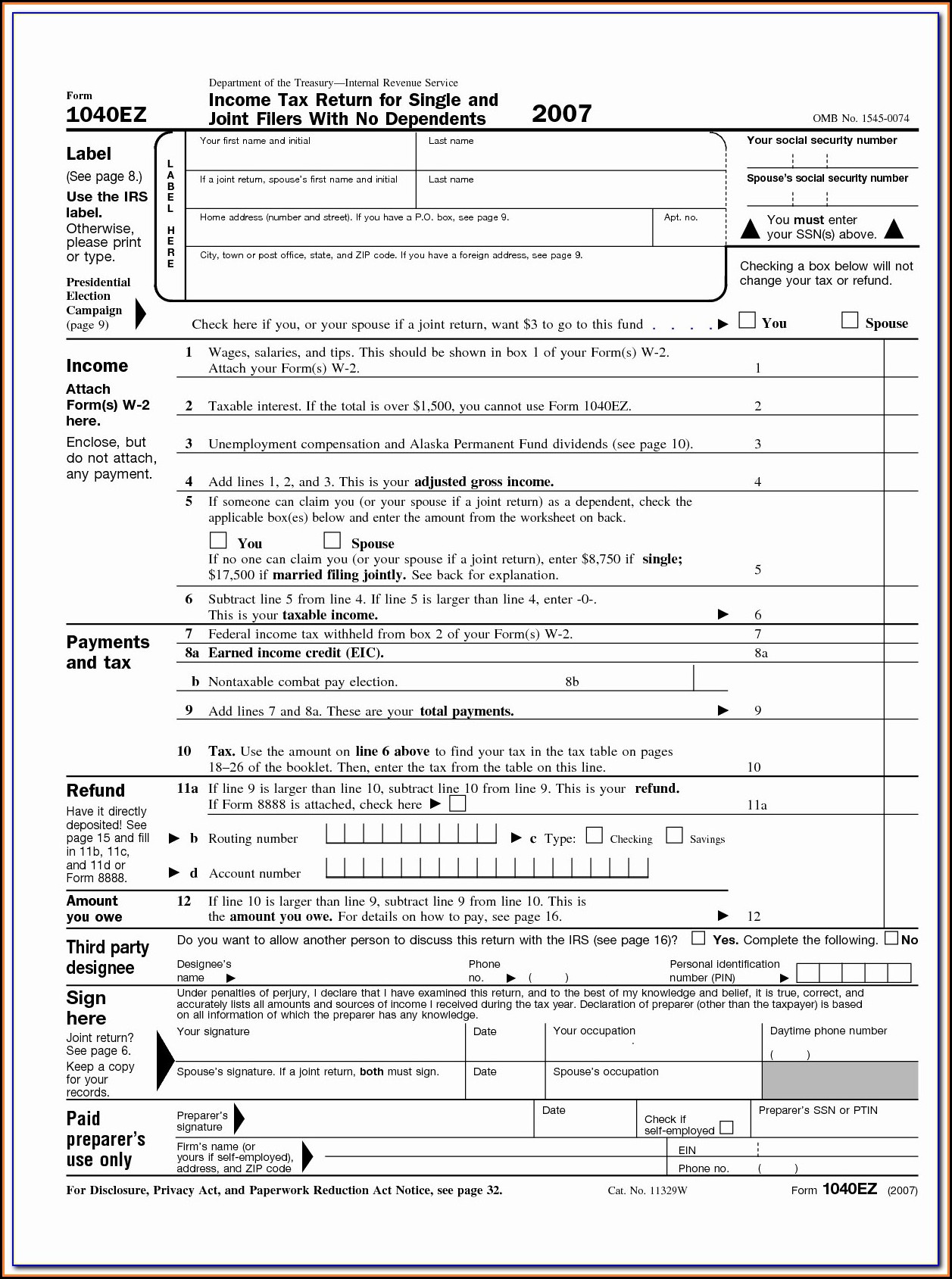

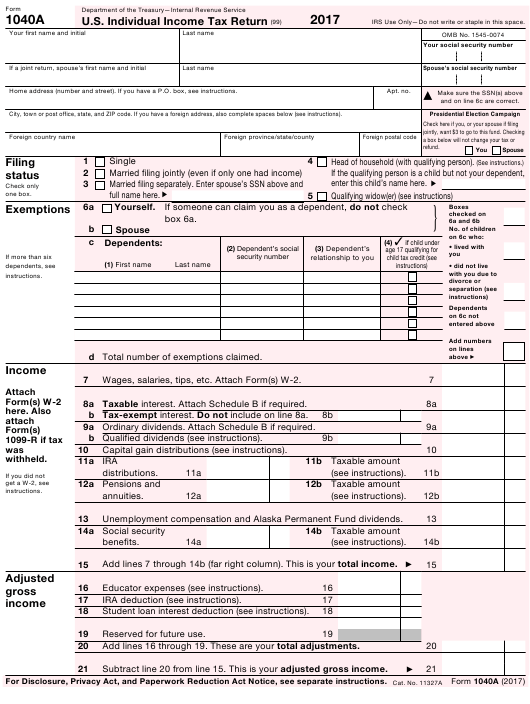

2019 Tax Forms 1040 Printable - Us individual income tax return. Web standard deduction for— • single or married filing separately, $12,200 • married filing jointly or qualifying widow(er), $24,400 • head of household, $18,350 • if. The short form 1040a and easy form 1040ez have been. Web home federal tax forms federal tax forms, instructions printable 2022 federal tax forms to prepare form. Annual income tax return filed by. Web 95 rows any us resident taxpayer can file form 1040 for tax year 2019. Web printable 2019 irs form 1040: Web since you can no longer file 2019 taxes online, use the 2019 forms below to prepare your 2019 return. These forms will open in. Filing status check only one box. Filing status check only one box. Web department of the treasury internal revenue service (99) profit or loss from business. These forms will open in. Web printable 2019 irs form 1040: As of 2019, there is just one version of the form 1040, which suggests all tax filers must use it. Us individual income tax return. Web how to generate an signature for the current tax return pdf form 1040 us individual income online 2019 1040 design 2019. Web 95 rows any us resident taxpayer can file form 1040 for tax year 2019. Web home federal tax forms federal tax forms, instructions printable 2022 federal tax forms to prepare form. Web. Single married filing jointly married filing separately. Web since you can no longer file 2019 taxes online, use the 2019 forms below to prepare your 2019 return. Filing status check only one box. Use fill to complete blank online. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax. Web find the 2019 federal tax forms you need. Web fill your taxes easily with printable 1040 tax forms. Web department of the treasury internal revenue service (99) profit or loss from business. Web how to generate an signature for the current tax return pdf form 1040 us individual income online 2019 1040 design 2019. As of 2019, there is. Web find the 2019 federal tax forms you need. Individual income tax return form. January 2019) department of the treasury—internal revenue service amended u.s. Us individual income tax return. Web form 1040 has been redesigned. Official irs income tax forms are printable and can be downloaded for free. Us individual income tax return. Web standard deduction for— • single or married filing separately, $12,200 • married filing jointly or qualifying widow(er), $24,400 • head of household, $18,350 • if. Use fill to complete blank online. Printable and fileable form 1040 for income earned. Individual income tax return form. Use fill to complete blank online. Web since you can no longer file 2019 taxes online, use the 2019 forms below to prepare your 2019 return. Web how to fill out 1040 form: Filing status check only one box. January 2019) department of the treasury—internal revenue service amended u.s. Printable and fileable form 1040 for income earned. Use fill to complete blank online. Web department of the treasury internal revenue service (99) profit or loss from business. Filing status check only one box. Web department of the treasury internal revenue service (99) profit or loss from business. Us individual income tax return. Printable and fileable form 1040 for income earned. Web fill your taxes easily with printable 1040 tax forms. Web printable 2019 irs form 1040: Single married filing jointly married filing separately. January 2019) department of the treasury—internal revenue service amended u.s. Web 95 rows any us resident taxpayer can file form 1040 for tax year 2019. Web fill your taxes easily with printable 1040 tax forms. Web home federal tax forms federal tax forms, instructions printable 2022 federal tax forms to prepare form. Printable and fileable form 1040 for income earned. Web since you can no longer file 2019 taxes online, use the 2019 forms below to prepare your 2019 return. Filing status check only one box. Web how to generate an signature for the current tax return pdf form 1040 us individual income online 2019 1040 design 2019. Web find the 2019 federal tax forms you need. Official irs income tax forms are printable and can be downloaded for free. Web home federal tax forms federal tax forms, instructions printable 2022 federal tax forms to prepare form. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax. Individual income tax return form. Web how to fill out 1040 form: January 2019) department of the treasury—internal revenue service amended u.s. Single married filing jointly married filing separately. Web fill online, printable, fillable, blank form 1040: Web 95 rows any us resident taxpayer can file form 1040 for tax year 2019. Web fill your taxes easily with printable 1040 tax forms. Web form 1040 has been redesigned. These forms will open in. As of 2019, there is just one version of the form 1040, which suggests all tax filers must use it. Annual income tax return filed by. Filing status check only one box. Use fill to complete blank online. Us individual income tax return. Web form 1040 has been redesigned. Web find the 2019 federal tax forms you need. Filing status check only one box. Web how to generate an signature for the current tax return pdf form 1040 us individual income online 2019 1040 design 2019. Web standard deduction for— • single or married filing separately, $12,200 • married filing jointly or qualifying widow(er), $24,400 • head of household, $18,350 • if. Annual income tax return filed by. Web form 1040 (2021) us individual income tax return for tax year 2021. Official irs income tax forms are printable and can be downloaded for free. As of 2019, there is just one version of the form 1040, which suggests all tax filers must use it. January 2019) department of the treasury—internal revenue service amended u.s. Web fill online, printable, fillable, blank form 1040: Single married filing jointly married filing separately. Web since you can no longer file 2019 taxes online, use the 2019 forms below to prepare your 2019 return. Web 95 rows any us resident taxpayer can file form 1040 for tax year 2019.Printable Tax Forms 1040ez 2019 Form Resume Examples vq1PyQrKkR

Form 1040 U S Individual Tax Return 2021 Tax Forms 1040 Printable

The New 2019 Form 1040 SR U S Tax Return For Seniors 2021 Tax Forms

1040A Form Fill Out and Sign Printable PDF Template signNow

New for 2019 taxes revised 1040 & only 3 schedules Don't Mess With Taxes

New for 2019 taxes revised 1040 & only 3 schedules Don't Mess With Taxes

Taxpayers Can Check The Status Of Their Refund On IRS.Gov Or The IRS2Go App

1040 Form 2020 📝 Get IRS 1040 Printable Form, Instructions, Fillable

Printable Tax Forms 1040ez 2019 Form Resume Examples WjYDGlb9KB

Printable Irs Tax Form 1040a Printable Form 2022

Printable And Fileable Form 1040 For Income Earned.

Web Fill Your Taxes Easily With Printable 1040 Tax Forms.

Web Libraries Irs Taxpayer Assistance Centers New 1040 Form For Older Adults The Irs Has Released A New Tax.

Individual Income Tax Return Form.

Related Post: