Irs Form 433 D Printable

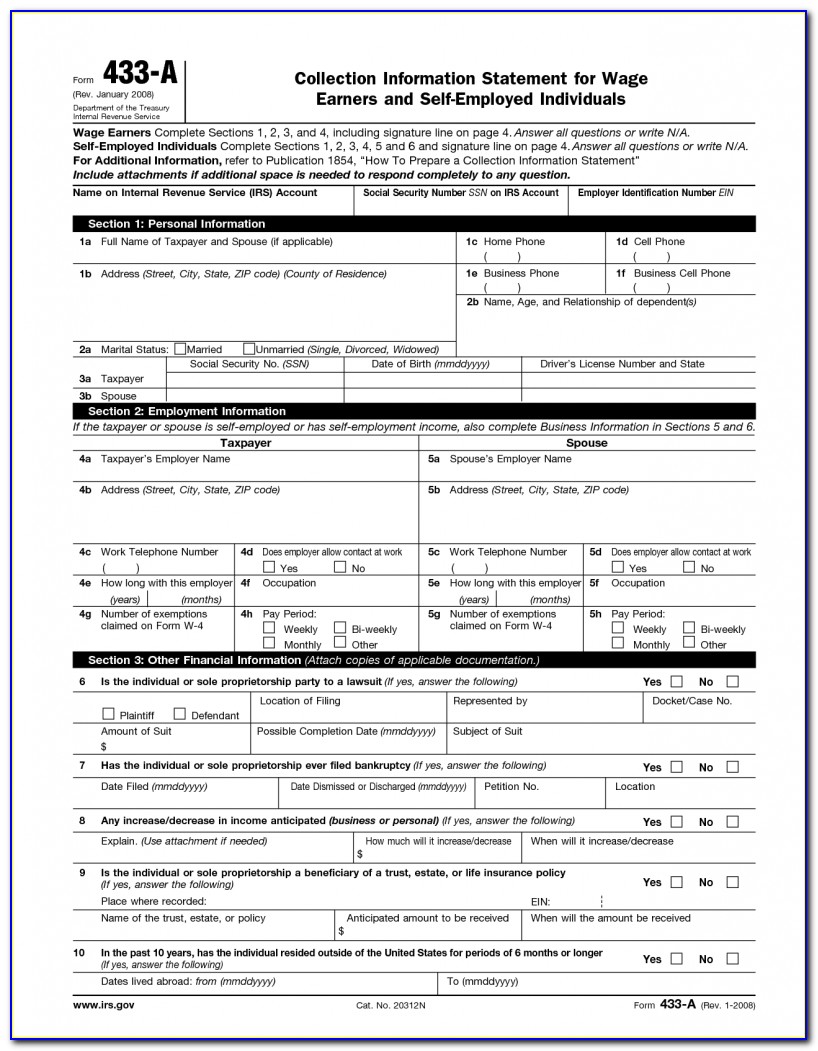

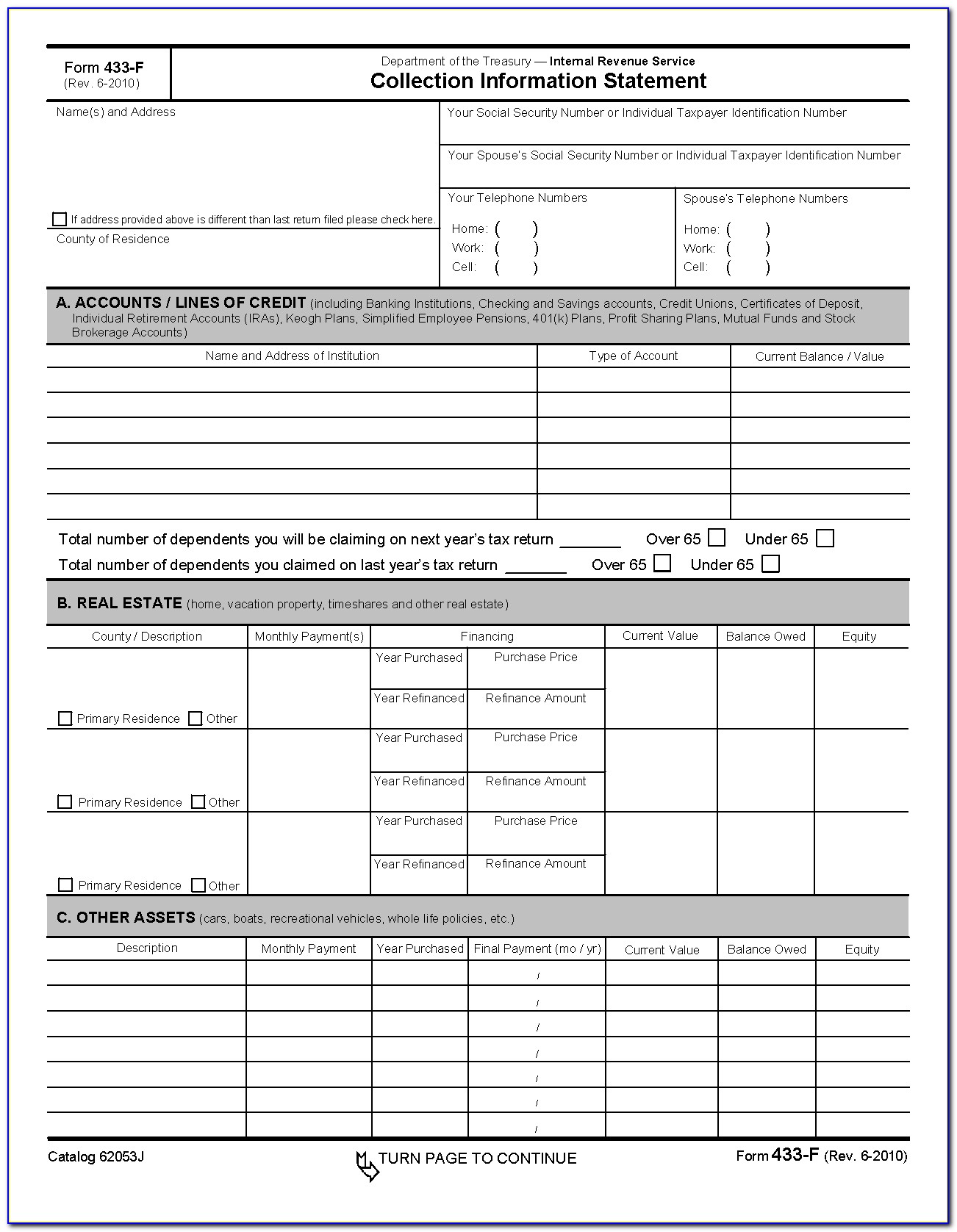

Irs Form 433 D Printable - Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. Web you may be eligible for a reduced user fee of $43. Web 4.7 satisfied 255 votes quick guide on how to complete where to mail form 433 d 2021 forget about scanning and printing out. Web find and fill out the correct irs form 433 d printable. Web the document you are trying to load requires adobe reader 8 or higher. Web (april 2023) department of the treasury — internal revenue service collection information statement for wage earners. Web edit irs form 433 d. Follow the instructions in this video to get. Edit your form 433d online type text, add images, blackout confidential details, add comments, highlights and more. See form 13844 for qualifications and instructions. This form is used by the united states internal revenue service. Web 4.7 satisfied 255 votes quick guide on how to complete where to mail form 433 d 2021 forget about scanning and printing out. Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. If you default on your.. The irs will review your financial information and may establish a payment agreement for you. See form 13844 for qualifications and instructions. Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. Web find and fill out the correct irs form 433 d printable. If you default on your. Web the document you are trying to load requires adobe reader 8 or higher. Web you may be eligible for a reduced user fee of $43. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and. This form is used by the united states internal revenue service. Follow the instructions in this video to get. See form 13844 for qualifications and instructions. Web 4.7 satisfied 255 votes quick guide on how to complete where to mail form 433 d 2021 forget about scanning and printing out. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and. Web edit irs form 433 d. Web what is an irs form 433d? Web video instructions and help with filling out and completing irs form 433 d printable. Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. This form is used by the united states internal revenue service. If you default on your. See form 13844 for qualifications and instructions. Web what is an irs form 433d? Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. The form is your basic installment. You may not have the adobe reader installed or your viewing environment may not be. The irs will review your financial information and may establish a payment. Web (april 2023) department of the treasury — internal revenue service collection information statement for wage earners. The form is your basic installment. If you default on your. Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. Web find and fill out the correct irs form 433 d printable. This form is used by the united states internal revenue service. See form 13844 for qualifications and instructions. Web edit irs form 433 d. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and. Edit your form 433d online type text, add images, blackout confidential details, add comments, highlights and more. Web video instructions and help with filling out and completing irs form 433 d printable. Web find and fill out the correct irs form 433 d printable. Web the document you are trying to load requires adobe reader 8 or higher. Web what is an irs form 433d? The form is your basic installment. Web (april 2023) department of the treasury — internal revenue service collection information statement for wage earners. This form is used by the united states internal revenue service. Follow the instructions in this video to get. See form 13844 for qualifications and instructions. Web like any other official document, this irs form specifies the significant rules for using the described. If you default on your. Web (april 2023) department of the treasury — internal revenue service collection information statement for wage earners. The form is your basic installment. Web what is an irs form 433d? This form is used by the united states internal revenue service. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and. The irs will review your financial information and may establish a payment agreement for you. Web edit irs form 433 d. Web video instructions and help with filling out and completing irs form 433 d printable. Web the document you are trying to load requires adobe reader 8 or higher. Web you may be eligible for a reduced user fee of $43. Web find and fill out the correct irs form 433 d printable. Edit your form 433d online type text, add images, blackout confidential details, add comments, highlights and more. Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. Follow the instructions in this video to get. You may not have the adobe reader installed or your viewing environment may not be. See form 13844 for qualifications and instructions. Web 4.7 satisfied 255 votes quick guide on how to complete where to mail form 433 d 2021 forget about scanning and printing out. Web the document you are trying to load requires adobe reader 8 or higher. Follow the instructions in this video to get. Web edit irs form 433 d. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and. You may not have the adobe reader installed or your viewing environment may not be. If you default on your. See form 13844 for qualifications and instructions. Web video instructions and help with filling out and completing irs form 433 d printable. Web you may be eligible for a reduced user fee of $43. This form is used by the united states internal revenue service. Edit your form 433d online type text, add images, blackout confidential details, add comments, highlights and more. Web (april 2023) department of the treasury — internal revenue service collection information statement for wage earners. Web like any other official document, this irs form specifies the significant rules for using the described tax payment method. The irs will review your financial information and may establish a payment agreement for you.Irs Form 433 D Printable Master of Documents

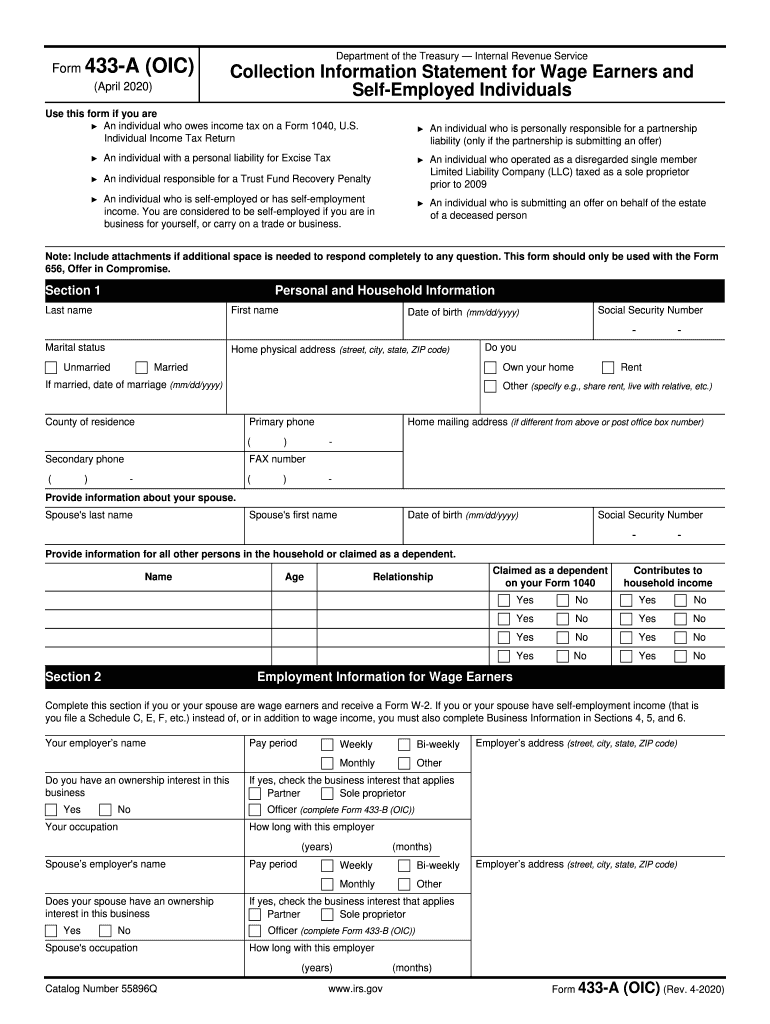

2020 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

Irs Form 433 D Printable Master of Documents

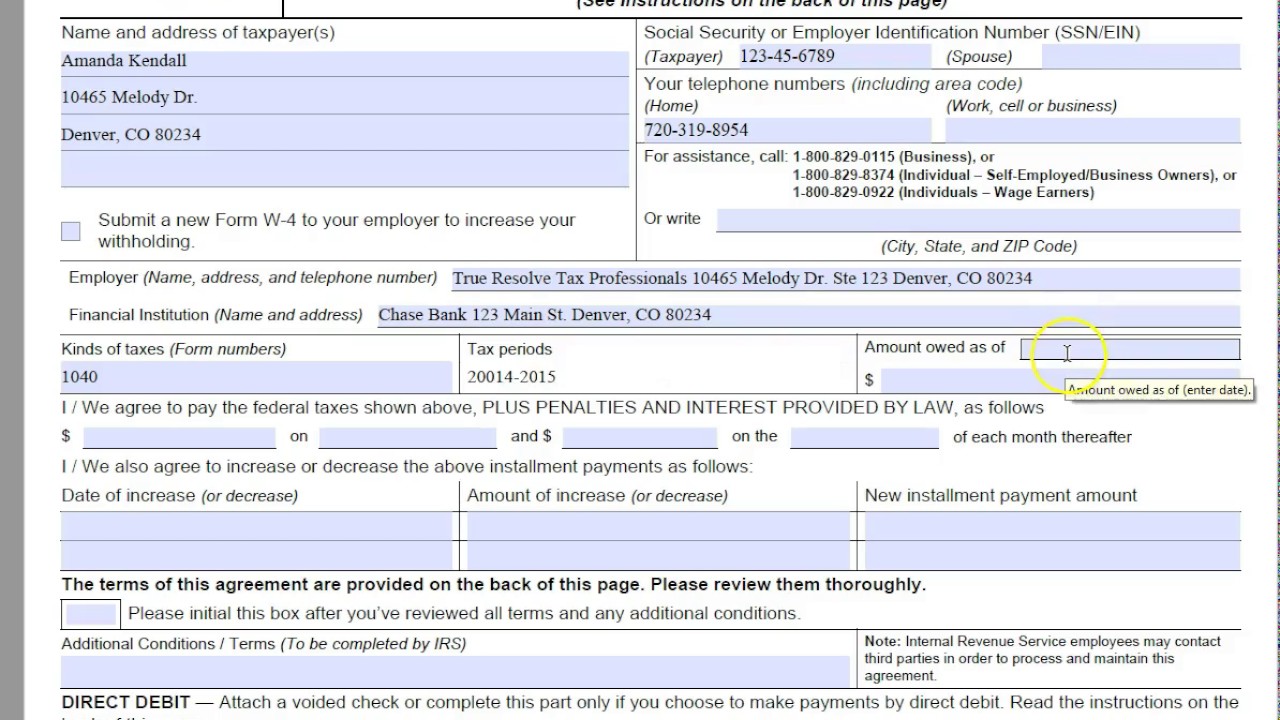

How To Fill Out Form 433 D Paul Johnson's Templates

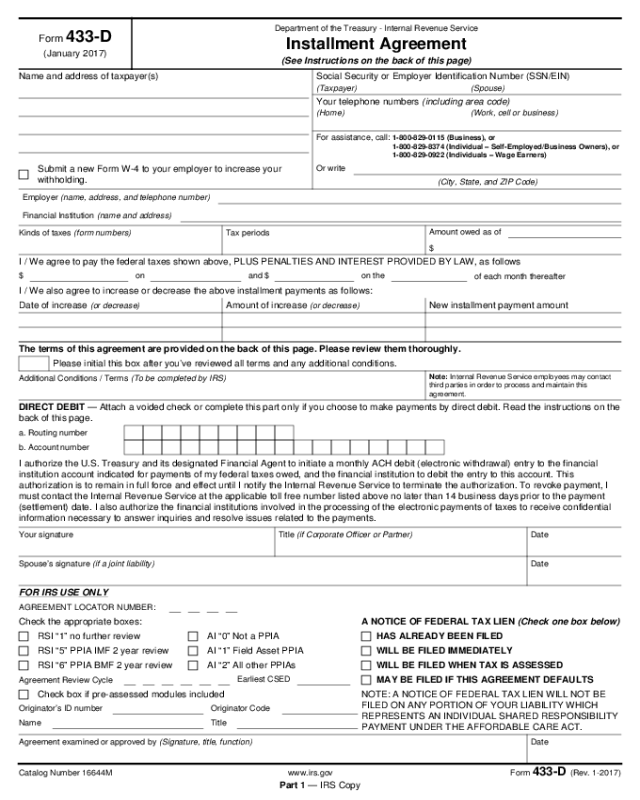

Form 433d Edit, Fill, Sign Online Handypdf

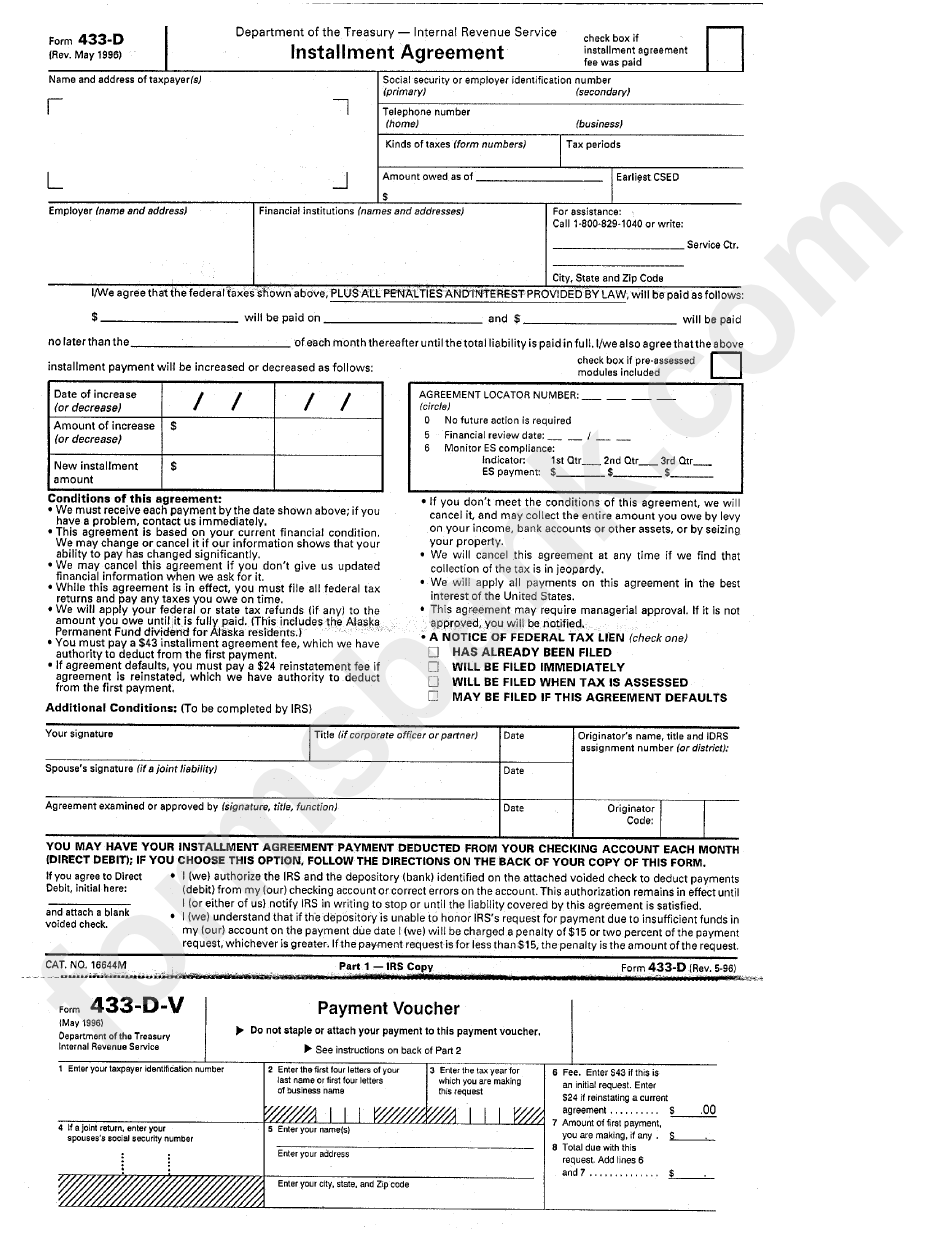

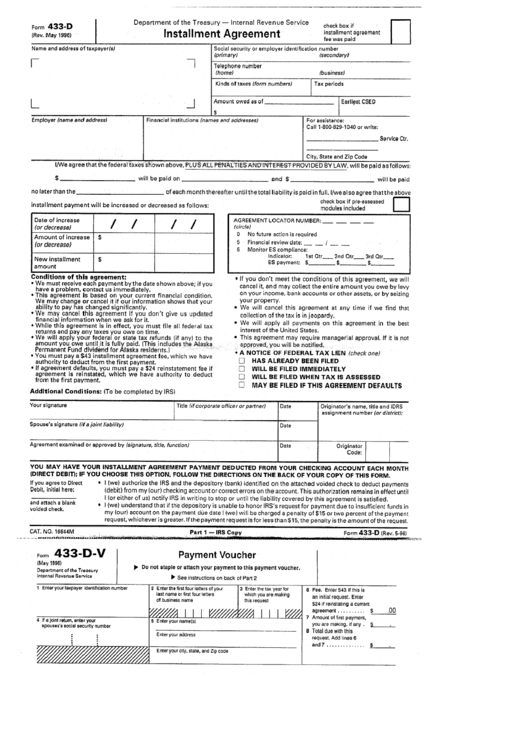

Form 433D Installment Agreement printable pdf download

Form 433D Installment Agreement Internal Revenue Service printable

How Do I Set Up an Installment Agreement IRS Just Sent Me Form 433 D

Aia G703 Form Instructions Form Resume Examples GEOGBBw5Vr

IRS Form 433D Fill out, Edit & Print Instantly

Web What Is An Irs Form 433D?

Web 4.7 Satisfied 255 Votes Quick Guide On How To Complete Where To Mail Form 433 D 2021 Forget About Scanning And Printing Out.

Web Find And Fill Out The Correct Irs Form 433 D Printable.

The Form Is Your Basic Installment.

Related Post: