Printable 1040Ez Forms

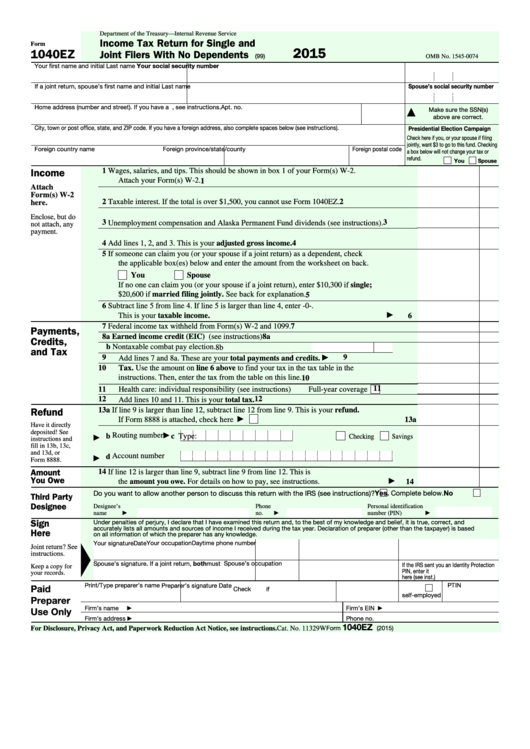

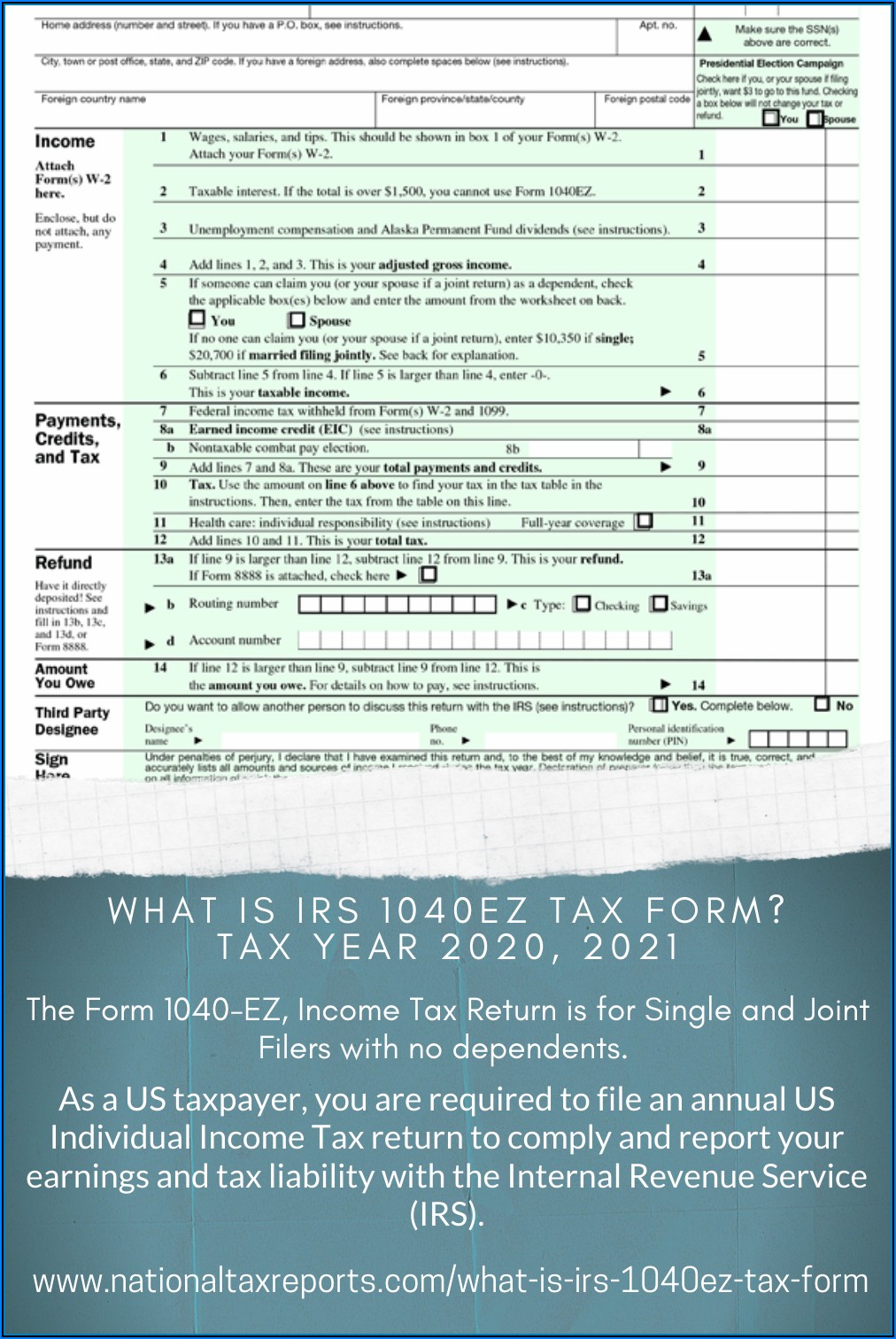

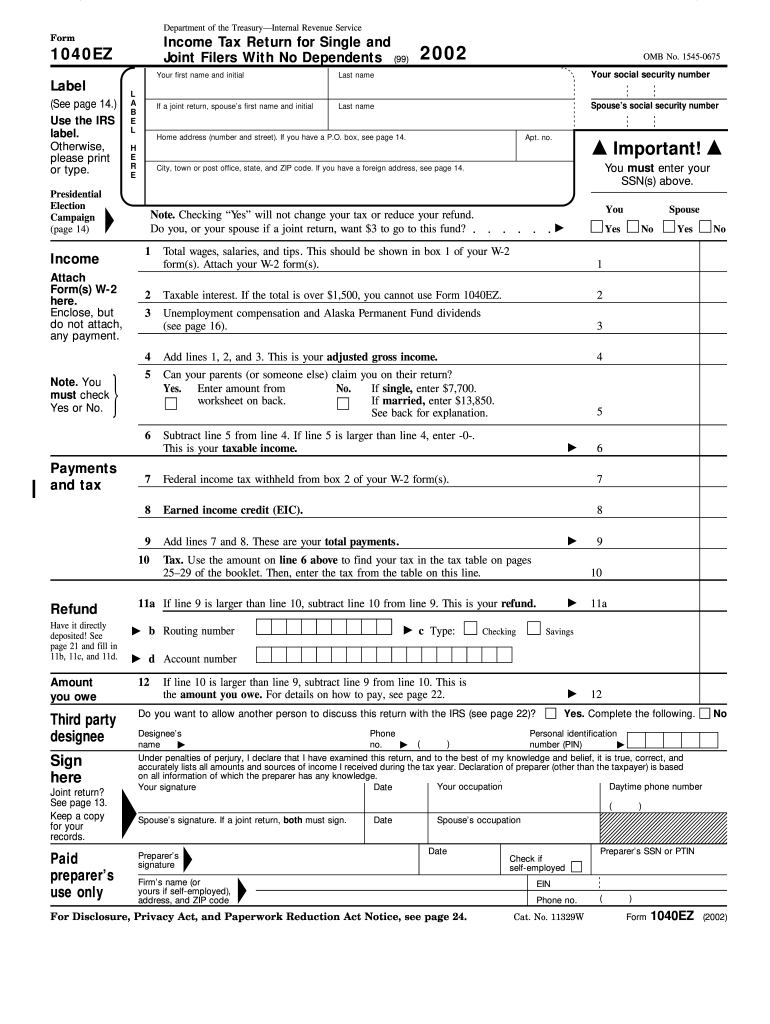

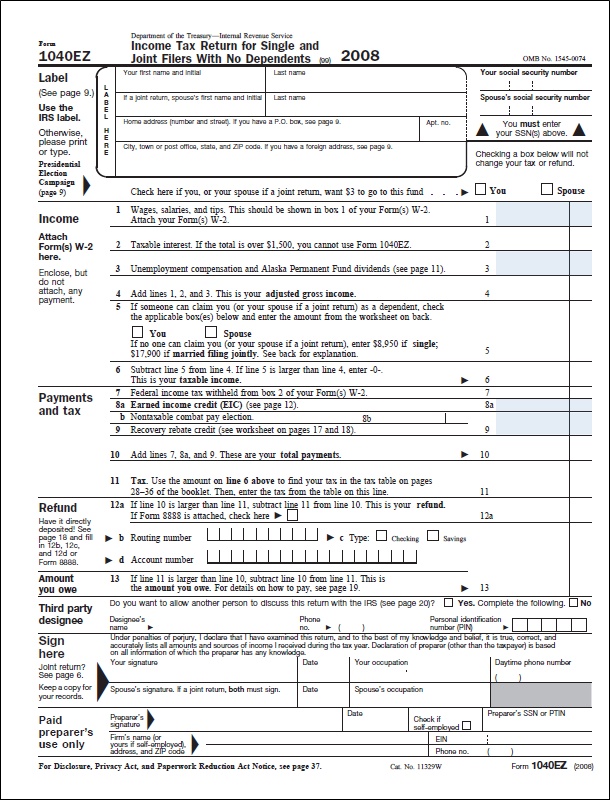

Printable 1040Ez Forms - Get paper copies of federal and state tax forms, their instructions, and the address. Web popular forms & instructions; Web irs form 1040ez is the simplest of the three tax forms you can use to file your federal income taxes. To start the document, utilize the fill & sign online button or tick the preview image of the form. Web planning to use form 1040ez for a child who received alaska permanent fund dividends, see instructions. Web the way to complete the printable 1040ez online: February 20, 2023 form 1040ez was a federal tax form used by. Individual tax return form 1040 instructions;. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web free printable 2022 1040ez form and 2022 1040ez instructions booklet sourced from the irs. If your taxable income is. Filling in your return if. Income tax return for single and joint filers with no dependents was the shortest version of. To start the document, utilize the fill & sign online button or tick the preview image of the form. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. February 20, 2023 form 1040ez was a federal tax form used by. Individual tax return form 1040 instructions;. Web popular forms & instructions; Web free printable 2022 1040ez form and 2022 1040ez instructions booklet sourced from the irs. Web before recent tax reforms, you could file with form 1040ez if: Individual tax return form 1040 instructions;. Get paper copies of federal and state tax forms, their instructions, and the address. Get ready for this year's tax season quickly and safely with. Individual tax return form 1040 instructions;. It allowed single and joint filers with no. Get ready for this year's tax season quickly and safely with. Web the way to complete the printable 1040ez online: Web get federal tax return forms and file by mail. It allowed single and joint filers with no. To open the printable 1040 ez form, you would need to click the fill out form button. Web popular forms & instructions; Web irs form 1040ez was a shortened version of the irs tax form 1040. Web before recent tax reforms, you could file with form 1040ez if: Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web form 1040ez department of the treasury—internal revenue service income tax return for single and. February 20, 2023 form 1040ez was a federal tax form used by. Individual tax return form 1040 instructions;. Web free printable 2022 1040ez form and 2022 1040ez instructions booklet sourced from the irs. Your filing status was single or married filing jointly. Use form 1040ez (quick & easy). To open the printable 1040 ez form, you would need to click the fill out form button. Web get federal tax return forms and file by mail. Filling in your return if. Individual tax return form 1040 instructions;. Your filing status was single or married filing jointly. Web popular forms & instructions; Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web what's the right form 1040 for me? Get ready for this year's tax season quickly and safely with. This form is for income. Individual income tax return 2022 department of the treasury—internal revenue service omb no. It allowed single and joint filers with no. This form is for income. Web irs form 1040ez is the simplest of the three tax forms you can use to file your federal income taxes. Web form 1040ez department of the treasury—internal revenue service income tax return for. Web planning to use form 1040ez for a child who received alaska permanent fund dividends, see instructions. Web what's the right form 1040 for me? Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Download and print the pdf file. Get ready for this year's tax season quickly and safely with. Get paper copies of federal and state tax forms, their instructions, and the address. Web what's the right form 1040 for me? To open the printable 1040 ez form, you would need to click the fill out form button. Web irs form 1040ez is the simplest of the three tax forms you can use to file your federal income taxes. Income tax return for single and joint filers with no dependents was the shortest version of. It allowed single and joint filers with no. To start the document, utilize the fill & sign online button or tick the preview image of the form. If your taxable income is. Web the way to complete the printable 1040ez online: Web planning to use form 1040ez for a child who received alaska permanent fund dividends, see instructions. Web popular forms & instructions; Web popular forms & instructions; Web irs form 1040ez was a shortened version of the irs tax form 1040. This form is for income. Use form 1040ez (quick & easy). Web form 1040ez department of the treasury—internal revenue service income tax return for single and joint. Filling in your return if. Individual income tax return 2022 department of the treasury—internal revenue service omb no. February 20, 2023 form 1040ez was a federal tax form used by. Download and print the pdf file. Web free printable 2022 1040ez form and 2022 1040ez instructions booklet sourced from the irs. Individual tax return form 1040 instructions;. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web irs form 1040ez is the simplest of the three tax forms you can use to file your federal income taxes. Web planning to use form 1040ez for a child who received alaska permanent fund dividends, see instructions. Download and print the pdf file. To start the document, utilize the fill & sign online button or tick the preview image of the form. Filling in your return if. Income tax return for single and joint filers with no dependents was the shortest version of. Web before recent tax reforms, you could file with form 1040ez if: Web get federal tax return forms and file by mail. February 20, 2023 form 1040ez was a federal tax form used by. Get paper copies of federal and state tax forms, their instructions, and the address. Web what's the right form 1040 for me? If your taxable income is. To open the printable 1040 ez form, you would need to click the fill out form button.1040ez Tax Form Form Resume Examples ABpV5eV1ZL

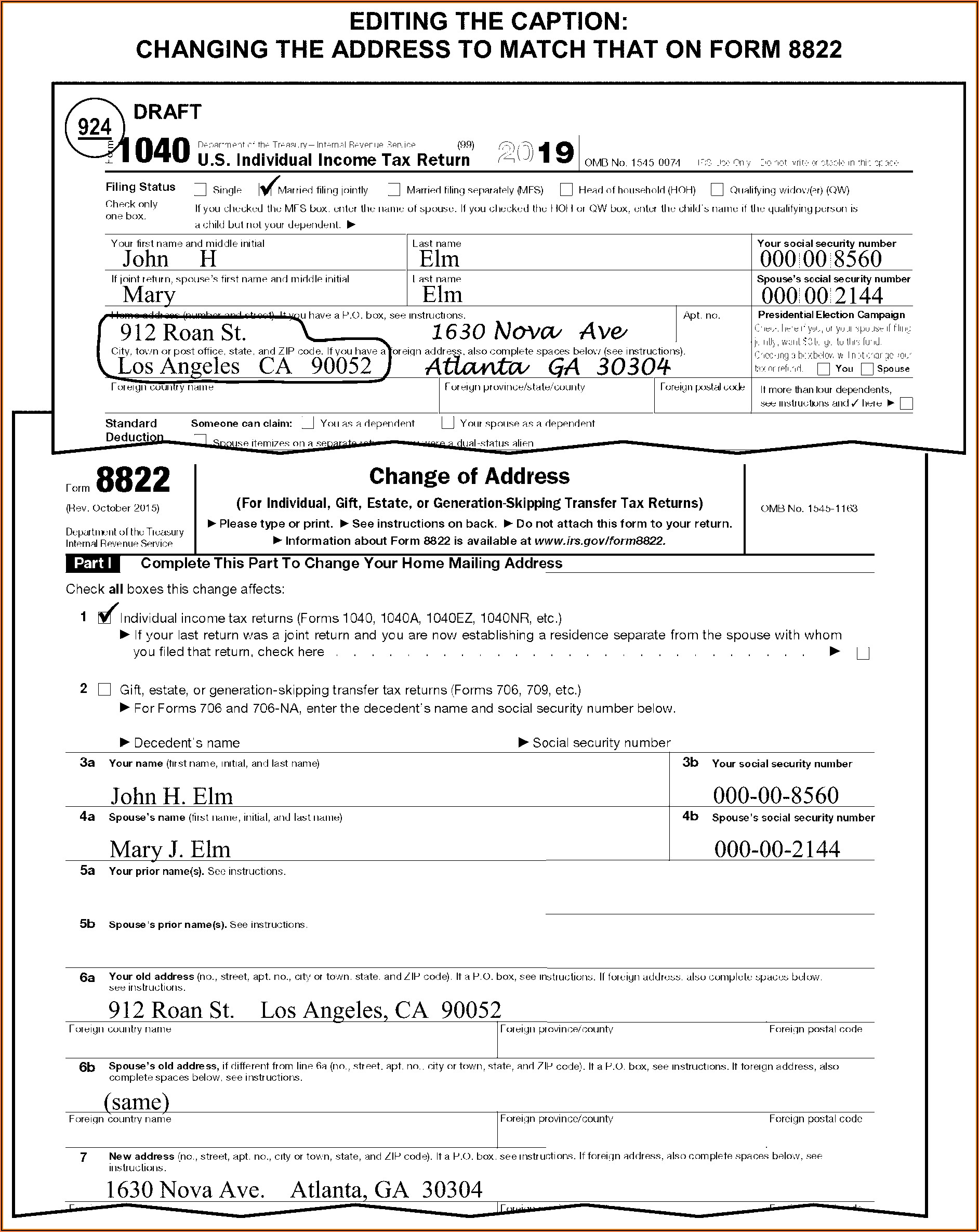

Printable Tax Forms 1040ez 2019 Form Resume Examples vq1PyQrKkR

Fillable Form 1040ez Tax Return For Single And Joint Filers

1040ez Form 2012 Printable Universal Network

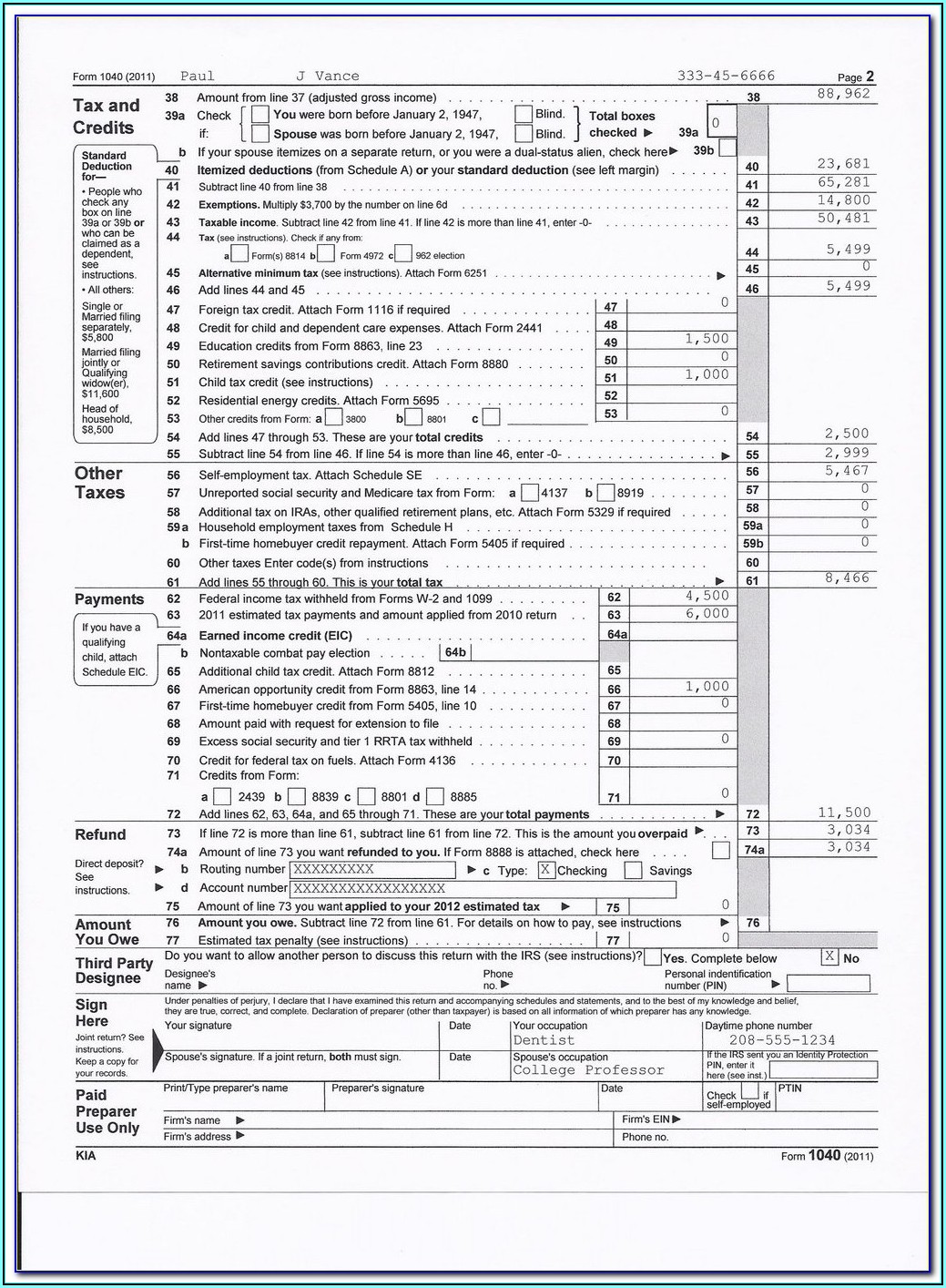

Irs Form 1040ez Tax Year 2011 Form Resume Examples

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

1040ez Tax Form Form Resume Examples ABpV5eV1ZL

1040ez Tax Forms Form Resume Examples EY390LjK2V

Printable 1040ez Form Fill Out and Sign Printable PDF Template signNow

2015 1040ez Tax Table Search Results Calendar 2015

Get Ready For This Year's Tax Season Quickly And Safely With.

Individual Income Tax Return 2020 Department Of The Treasury—Internal Revenue Service (99) Omb No.

Web Form 1040Ez Department Of The Treasury—Internal Revenue Service Income Tax Return For Single And Joint.

This Form Is For Income.

Related Post: