Printable 1041 Tax Form

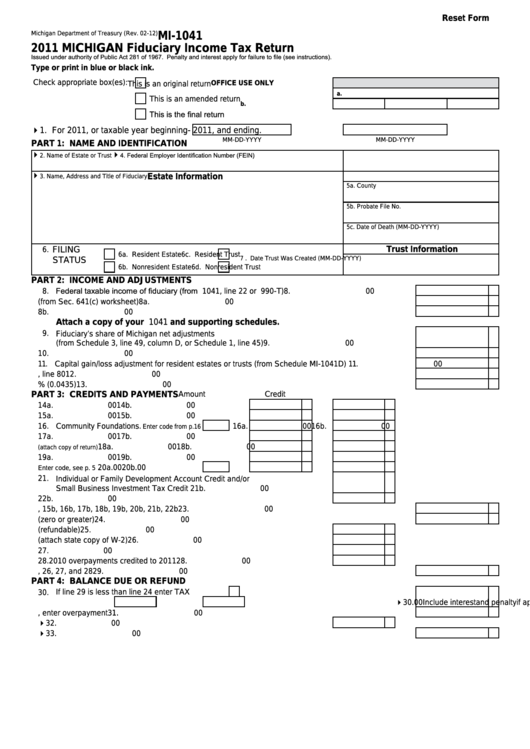

Printable 1041 Tax Form - Web go to www.irs.gov/form1041 for instructions and the latest information. Web form 1041 is a federal estate tax form. Web to fill out the blank irs form 1041 correctly, follow these steps: Web form 1041 department of the treasury—internal revenue service. Irs 1041 is an official form of tax return that can be used by trusts. Web publication 17 (2021) pdf form 1040 (2020) us individual income tax return for tax year 2020. Web information about form 1041, u.s. Was the trust a specified domestic entity required to file form 8938 for the tax year? Web form 1041 basics. Income tax return for estates and trusts, including recent updates, related forms and. Get the current filing year’s forms, instructions, and publications for free from the irs. In the year of a person’s death, he or she leaves both personal income and, in some cases,. Web the due date for filing a printable 1041 tax form for 2022 is april 15th, 2023, as it aligns with the traditional deadline for individual income annual. Was the trust a specified domestic entity required to file form 8938 for the tax year? Income tax return for estates and trusts, including recent updates, related forms and. Web go to www.irs.gov/form1041 for instructions and the latest information. Web form 1041 basics. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is. Get the current filing year’s forms, instructions, and publications for free from the irs. Web for tax year 2022, the 20% maximum capital gains rate applies to estates and trusts with income above $13,700. Web information about form 1041, u.s. Web the 2023 form 1041 isn't available by the time the estate or trust is required to file its tax. Web for tax year 2022, the 20% maximum capital gains rate applies to estates and trusts with income above $13,700. Web irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. However, the estate or trust. Web information about form 1041, u.s. Get the current filing year’s forms, instructions, and publications. Web irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. Web go to www.irs.gov/form1041 for instructions and the latest information. Obtain the irs form 1041 printable for 2022, which can be found on. Web form 1041 basics. Web popular forms & instructions; Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and. Web the due date for filing a printable 1041 tax form for 2022 is april 15th, 2023, as it aligns with the traditional deadline for individual income annual returns. In the year of a person’s death, he or she. However, the estate or trust. Income tax return for estates and trusts, including recent updates, related forms and. Was the trust a specified domestic entity required to file form 8938 for the tax year? Obtain the irs form 1041 printable for 2022, which can be found on. Web form 1041 department of the treasury—internal revenue service. Web publication 17 (2021) pdf form 1040 (2020) us individual income tax return for tax year 2020. Irs 1041 is an official form of tax return that can be used by trusts. Get the current filing year’s forms, instructions, and publications for free from the irs. Web form 1041 department of the treasury—internal revenue service. Web to fill out the. Web get printable irs form 1041 to file in 2023. Get the current filing year’s forms, instructions, and publications for free from the irs. In the year of a person’s death, he or she leaves both personal income and, in some cases,. Irs 1041 is an official form of tax return that can be used by trusts. Web 01 fill. Web first, follow the link on our website to obtain irs form 1041 fillable pdf. Web information about form 1041, u.s. Get the current filing year’s forms, instructions, and publications for free from the irs. In the year of a person’s death, he or she leaves both personal income and, in some cases,. Web form 1041 is a federal estate. Web information about form 1041, u.s. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web for tax year 2022, the 20% maximum capital gains rate applies to estates and trusts with income above $13,700. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? In the year of a person’s death, he or she leaves both personal income and, in some cases,. Web go to www.irs.gov/form1041 for instructions and the latest information. However, the estate or trust. Print irs form 1041 or use a handy editor to complete & file the pdf online. Next, fill in the required information using the relevant. Web the 2023 form 1041 isn't available by the time the estate or trust is required to file its tax return. Individual tax return form 1040 instructions;. Web irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. Web first, follow the link on our website to obtain irs form 1041 fillable pdf. Web get printable irs form 1041 to file in 2023. Web popular forms & instructions; Irs 1041 is an official form of tax return that can be used by trusts. Web go to www.irs.gov/form1041 for instructions and the latest information. Web the due date for filing a printable 1041 tax form for 2022 is april 15th, 2023, as it aligns with the traditional deadline for individual income annual returns. Web to fill out the blank irs form 1041 correctly, follow these steps: Web form 1041 basics. Web irs form 1041 is an income tax return filed by a decedent's estate or living trust after their death. Web get printable irs form 1041 to file in 2023. Web form 1041 is a federal estate tax form. Web get federal tax forms. Web information about form 1041, u.s. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and. Print irs form 1041 or use a handy editor to complete & file the pdf online. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? Web publication 17 (2021) pdf form 1040 (2020) us individual income tax return for tax year 2020. Income tax return for estates and trusts, including recent updates, related forms and. Get the current filing year’s forms, instructions, and publications for free from the irs. In the year of a person’s death, he or she leaves both personal income and, in some cases,. Web first, follow the link on our website to obtain irs form 1041 fillable pdf. Web form 1041 basics. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web the due date for filing a printable 1041 tax form for 2022 is april 15th, 2023, as it aligns with the traditional deadline for individual income annual returns.Fillable Form Mi1041 Michigan Fiduciary Tax Return 2011

IRS 1041ES 20202022 Fill out Tax Template Online US Legal Forms

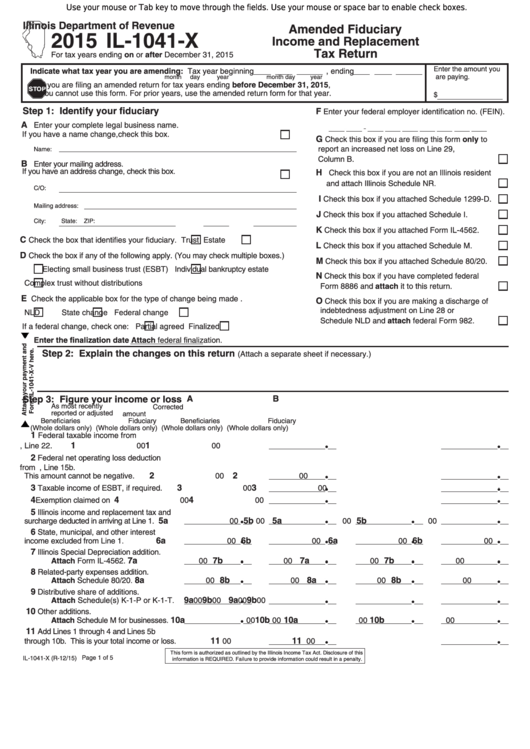

Fillable Form Il1041X Amended Fiduciary And Replacement Tax

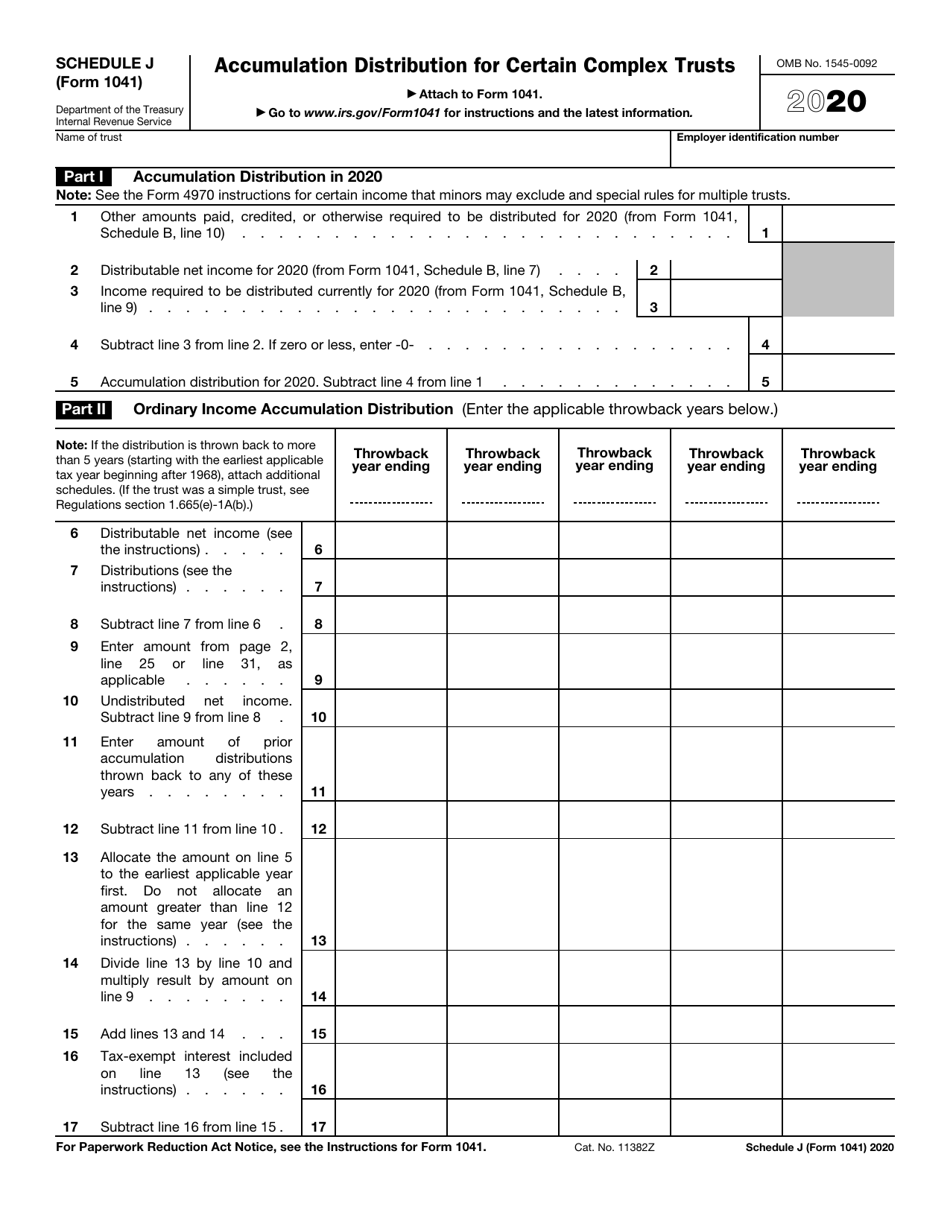

IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

1041 Schedule D Tax Worksheet

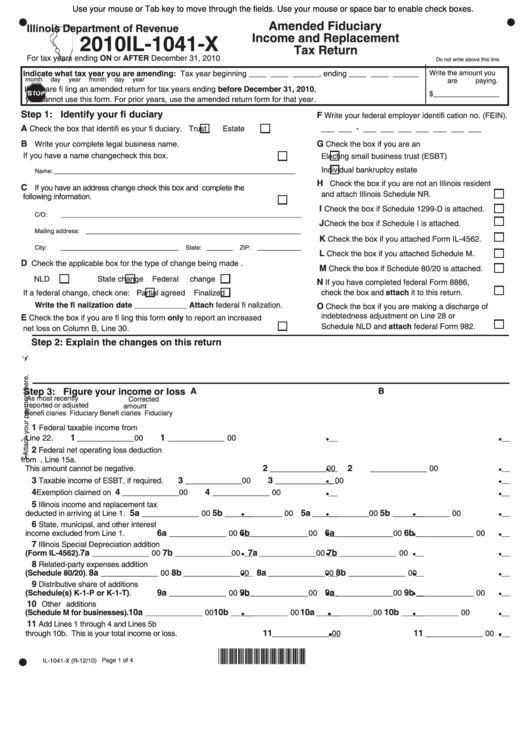

Fillable Form Il1041X Amended Fiduciary And Replacement Tax

2019 Form IRS 1041 Fill Online, Printable, Fillable, Blank pdfFiller

U.S. Tax Return for Estates and Trusts, Form 1041

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

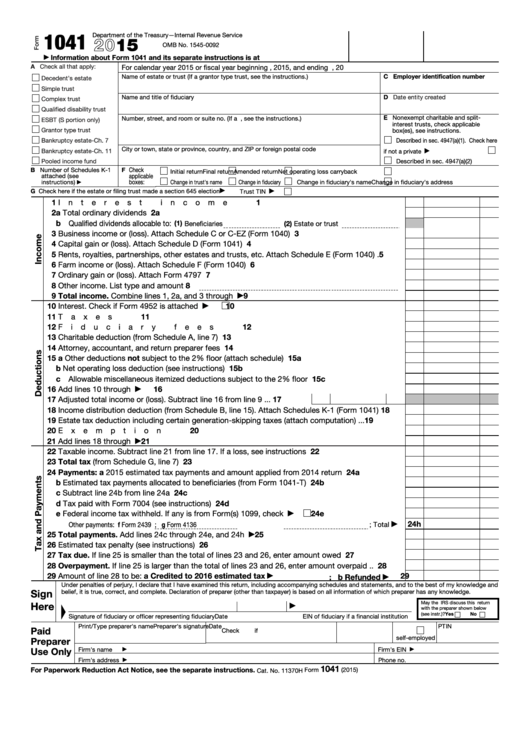

2015 Irs Form 1041 Form Resume Examples dP9lgv62RD

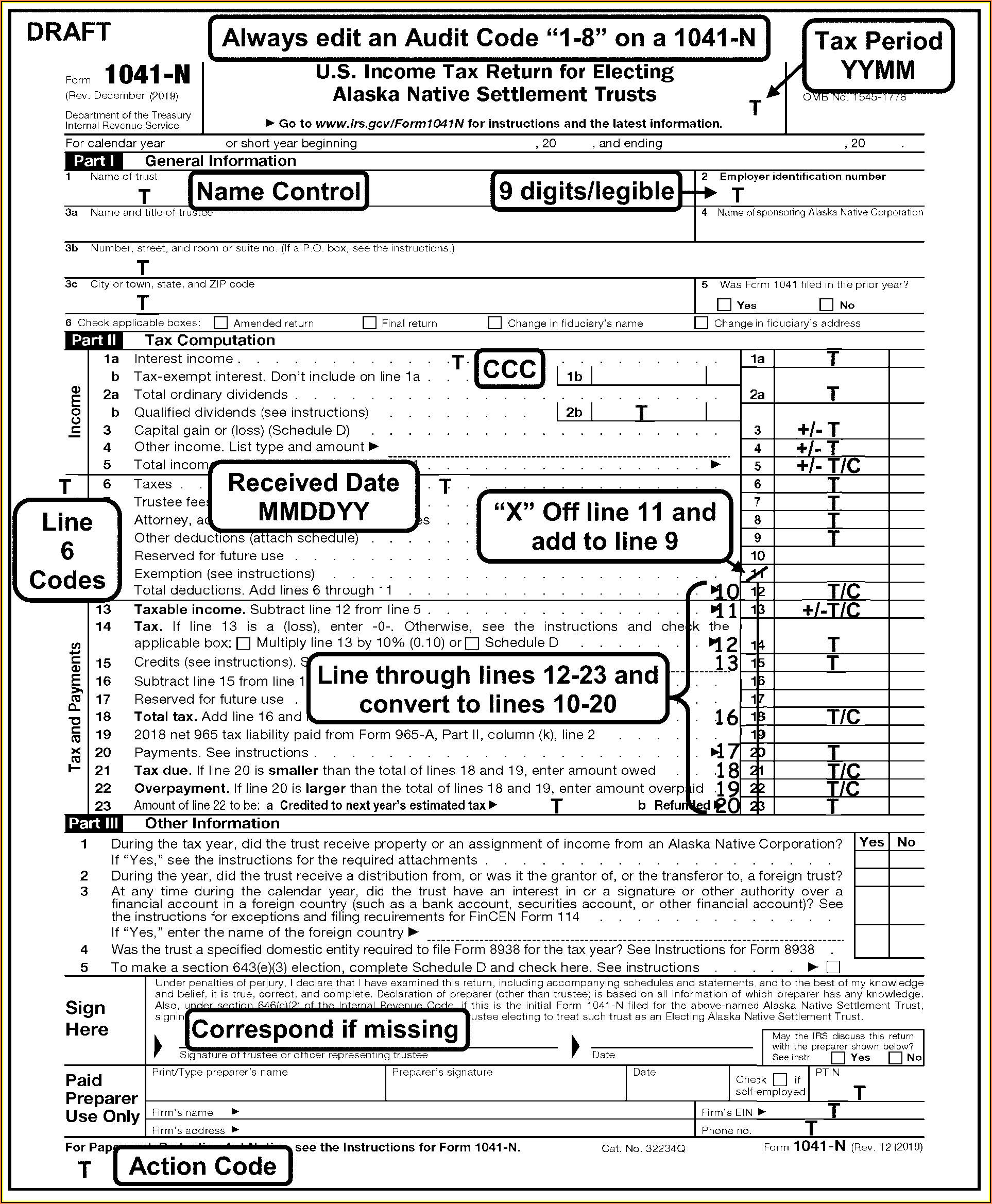

Was The Trust A Specified Domestic Entity Required To File Form 8938 For The Tax Year?

Web To Fill Out The Blank Irs Form 1041 Correctly, Follow These Steps:

Download The 1041 Tax Form & Fill It Out With Our Detailed Instructions.

However, The Estate Or Trust.

Related Post: