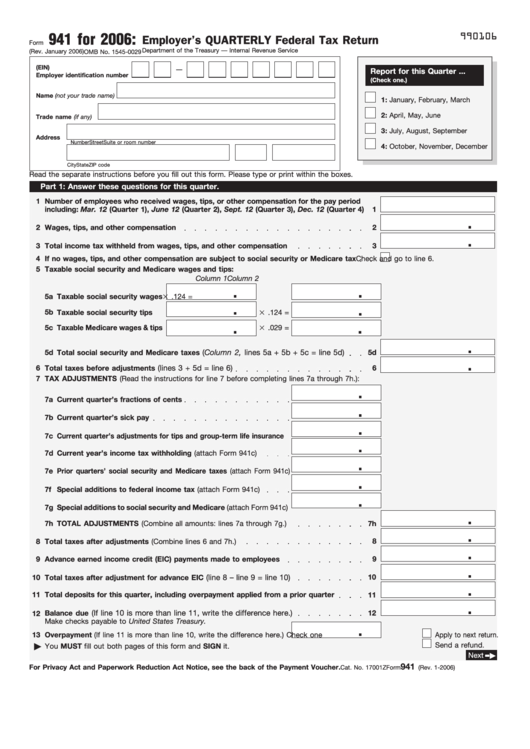

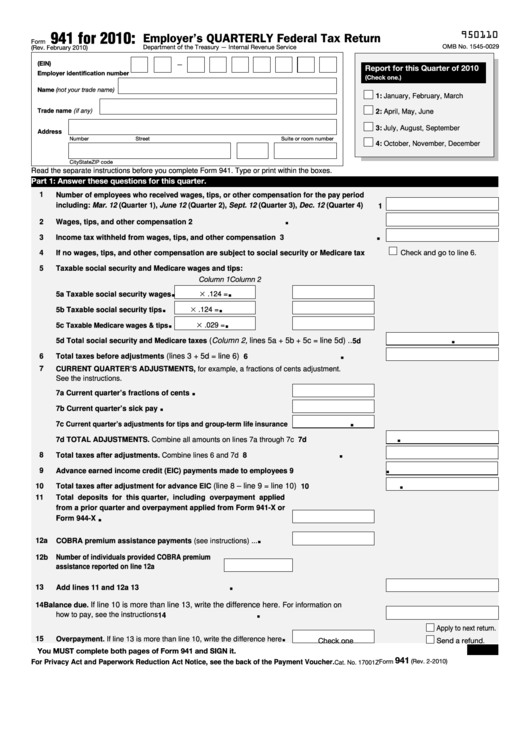

Printable Form 941

Printable Form 941 - You must also complete the entity information. Employer\\'s quarterly federal tax return: Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web do whatever you want with a form 941 (rev. April, may, june read the separate. Web form 941 for 2021: Type or print within the boxes. Web we last updated federal form 941 in july 2022 from the federal internal revenue service. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. March 2021) employer’s quarterly federal tax return department of the treasury — internal. Web do whatever you want with a form 941 (rev. Type or print within the boxes. Web form 941 for 2022: Read the separate instructions before you complete form. Read the separate instructions before you complete form 941. Web and form 941 to the address in the instructions for form 941. Web the 941 form is a quarterly tax form required by the irs for employers to report withheld federal income taxes and fica taxes. You must also complete the entity information. Web do whatever you want with a form 941 (rev. March 2022) employer’s quarterly federal tax. Employer identification number (ein) small businesses. March 2022) employer’s quarterly federal tax return department of the treasury — internal. Web do whatever you want with a form 941 (rev. Type or print within the boxes. Type or print within the. Web and form 941 to the address in the instructions for form 941. Web purpose of form 941. Type or print your ein, name, and address in the spaces provided. Web how should you complete form 941? Type or print within the. Web go to www.irs.gov/form941 for instructions and the latest information. Read the separate instructions before you complete form. Web the 941 form is a quarterly tax form required by the irs for employers to report withheld federal income taxes and fica taxes. Report of tax liability for semiweekly schedule depositors (rev. Employer\\'s quarterly federal tax return: Web go to www.irs.gov/form941 for instructions and the latest information. Web form 941, employer's quarterly federal tax return; You must also complete the entity information. Web schedule b (form 941): Web go to www.irs.gov/form941 for instructions and the latest information. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web read the separate instructions before you complete form 941. Web form 941 for 2021: April, may, june read the separate. Who must file form 941? Read the separate instructions before you complete form 941. Type or print within the boxes. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Employer identification number (ein) small businesses. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. You must fill out this form if you meet the following conditions: Web read the separate instructions before you complete form 941. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. January 2017) department of the treasury — internal. Web form 941 for 2021: Web how should you complete form 941? Report of tax liability for semiweekly schedule depositors (rev. Web schedule b (form 941): Employer identification number (ein) small businesses. You must also complete the entity information. Report of tax liability for semiweekly schedule depositors (rev. January 2017) department of the treasury — internal. Employer\\'s quarterly federal tax return: You must also complete the entity information. March 2021) employer’s quarterly federal tax return department of the treasury — internal. Fill, sign, print and send online. This form is for income earned in. Read the separate instructions before you complete form 941. Web read the separate instructions before you complete form 941. Web the 941 form is a quarterly tax form required by the irs for employers to report withheld federal income taxes and fica taxes. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Read the separate instructions before you complete form. Web we last updated federal form 941 in july 2022 from the federal internal revenue service. March 2022) employer’s quarterly federal tax return department of the treasury — internal. Web form 941 for 2021: Web schedule b (form 941): Web read the separate instructions before you complete form 941. Web go to www.irs.gov/form941 for instructions and the latest information. April, may, june read the separate. Web schedule b (form 941): April, may, june read the separate. Type or print within the. Web we last updated federal form 941 in july 2022 from the federal internal revenue service. Employer identification number (ein) small businesses. March 2022) employer’s quarterly federal tax return department of the treasury — internal. Web go to www.irs.gov/form941 for instructions and the latest information. June 2021) employer’s quarterly federal tax return department of the treasury — internal. Web the 941 form is a quarterly tax form required by the irs for employers to report withheld federal income taxes and fica taxes. Who must file form 941? Web form 941, employer's quarterly federal tax return; You must fill out this form if you meet the following conditions: Type or print your ein, name, and address in the spaces provided. March 2021) employer’s quarterly federal tax return department of the treasury — internal. Web and form 941 to the address in the instructions for form 941. Web form 941 for 2021:form 941 DriverLayer Search Engine

941 X Printable Blank PDF Online

Form 941 3Q 2020

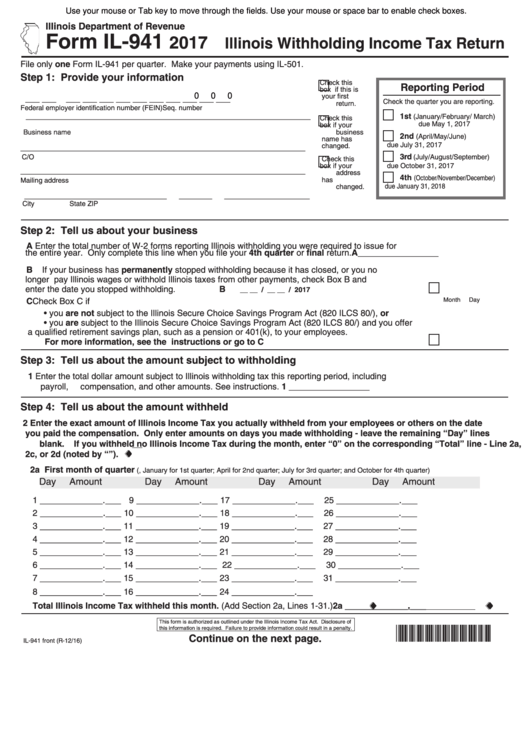

Fillable Form Il941 Illinois Withholding Tax Return 2017

Form 941

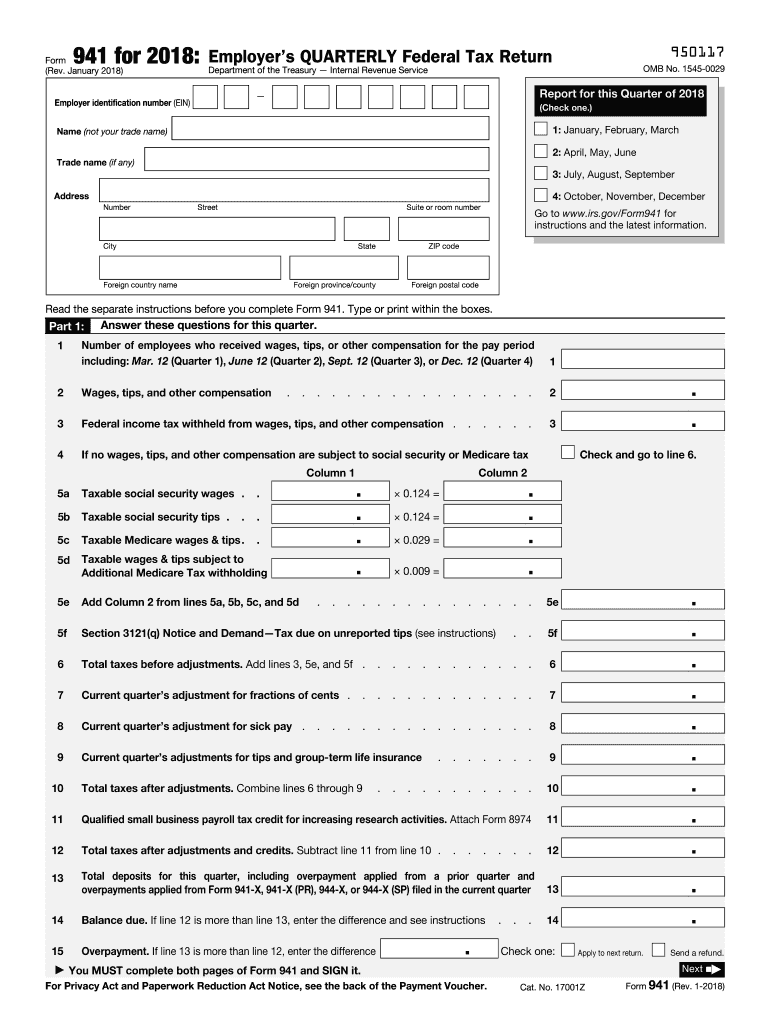

2018 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

941 Archives Payroll Partners

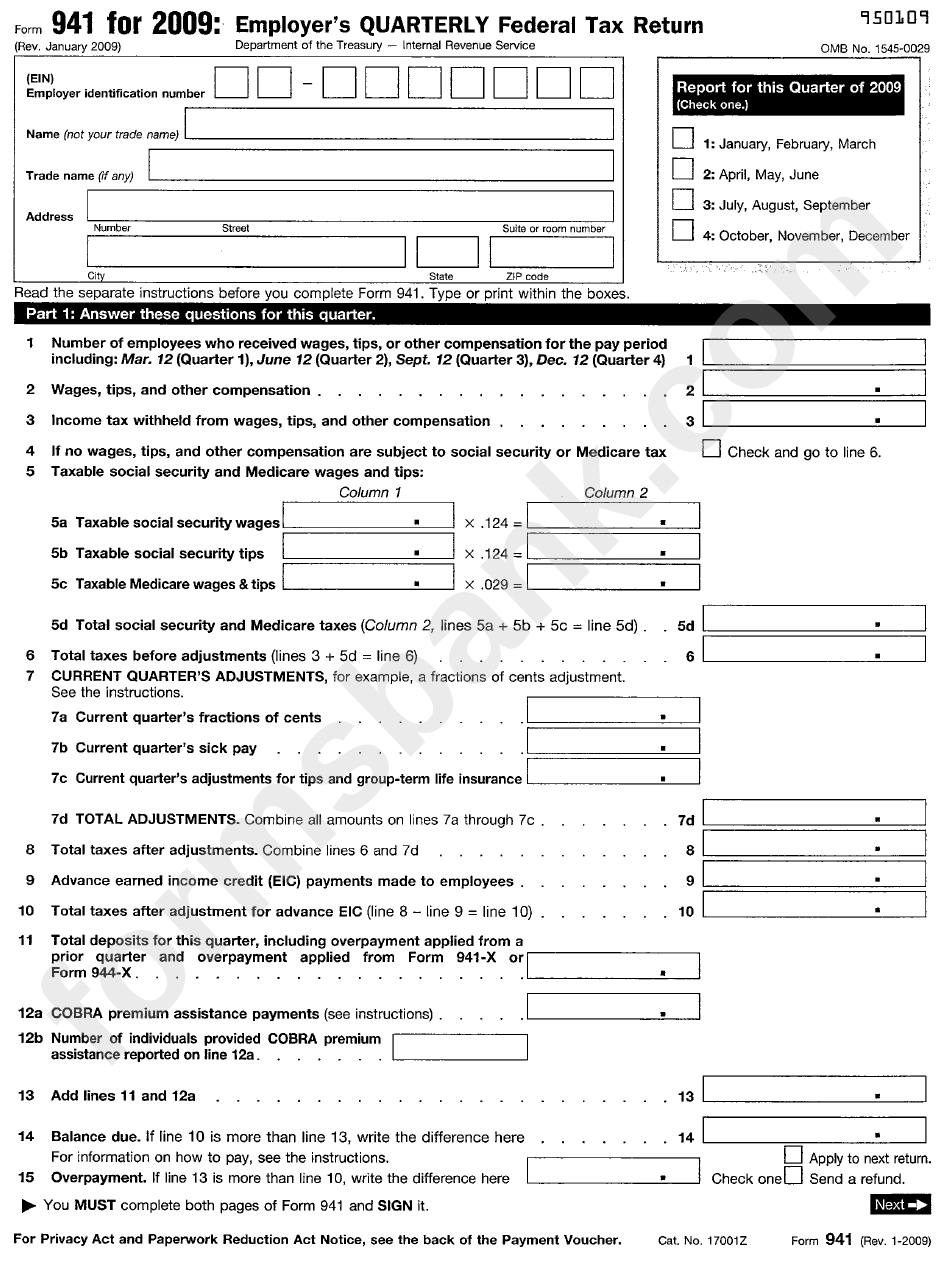

Form 941 Employer'S Quarterly Federal Tax Return 2009 printable pdf

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Fillable Form 941 Employer'S Quarterly Federal Tax Return 2010

Read The Separate Instructions Before You Complete Form.

Type Or Print Within The Boxes.

Read The Separate Instructions Before You Complete Form 941.

Web Irs Form 941 Is A Form Businesses File Quarterly To Report Taxes They Withheld From Employee Paychecks.

Related Post: