Printable Itemized Deductions Worksheet

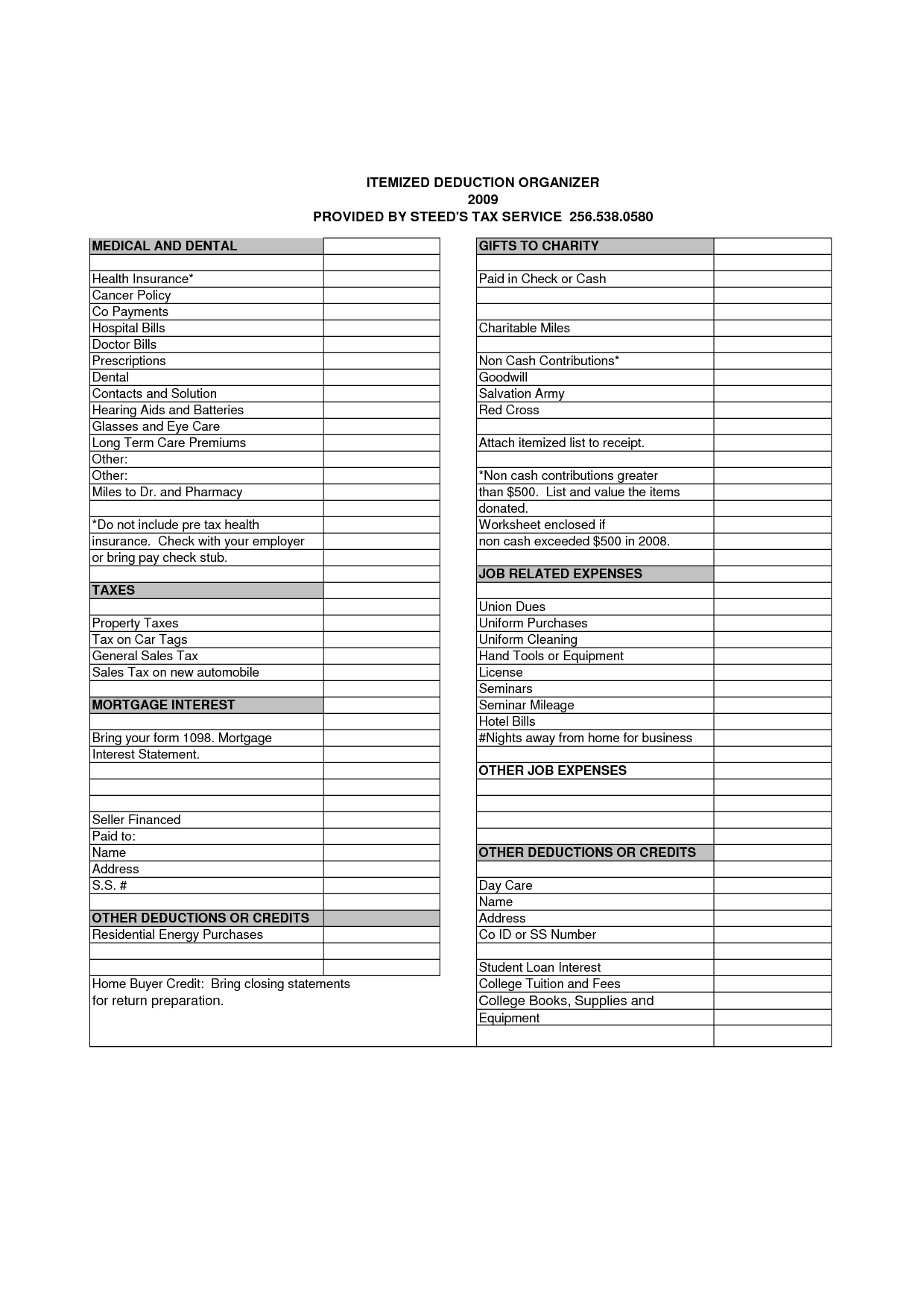

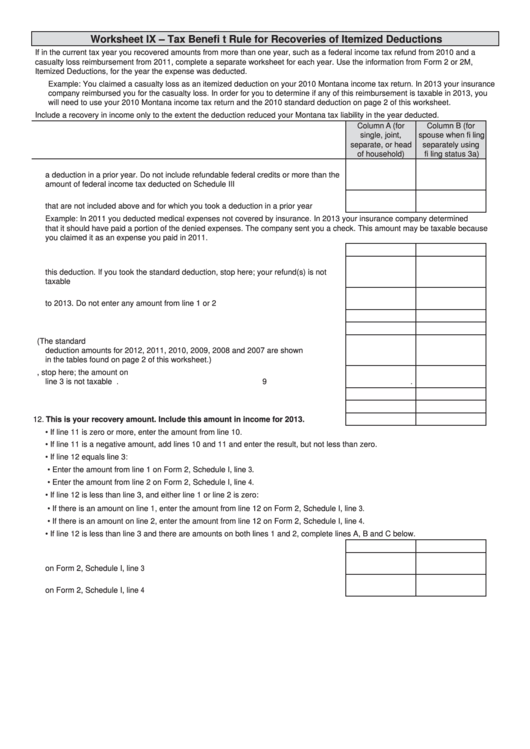

Printable Itemized Deductions Worksheet - $4,520 age 71 and over: In most cases, your federal income tax will be less if you take. • determine if a taxpayer should itemize deductions • determine the type of. Web the itemized deduction for state and local taxes and sales and property taxes is limited to a combined,. At the end of this lesson, using your resource materials, you will be able to: Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Web this schedule is used by filers to report itemized deductions. $5,640 the limit on premiums is. Web worksheet allows you to itemize your tax deductions for a given year. Web use schedule a (form 1040) to figure your itemized deductions. After downloading the free template to your computer, you will automatically start on the first tab of the. $1,690 age 61 to 70: Web worksheet allows you to itemize your tax deductions for a given year. Web you can also deduct certain casualty and theft losses. • determine if a taxpayer should itemize deductions • determine the type of. Web complete printable itemized deductions worksheet online with us legal forms. $5,640 the limit on premiums is. If you and your spouse paid expenses jointly and are filing separate returns for 2016, see pub. After downloading the free template to your computer, you will automatically start on the first tab of the. Web this schedule is used by filers to. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. $1,690 age 61 to 70: Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Web worksheet allows you to itemize your tax deductions for a given year. Web age 40 or under: Easily fill out pdf blank, edit, and. Web your itemized deduction expenses must exceed: Easily fill out pdf blank, edit, and. At the end of this lesson, using your resource materials, you will be able to: (any one contribution of $250 or more needs written evidence) Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. We will determine whether your total itemized deductions or the standard deduction for. $850 age 51 to 60: At the end of this lesson, using your resource materials, you will be able to: • determine if a taxpayer should itemize deductions • determine the type of. Web if you expect to claim deductions other than the standard deduction and want. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web age 40 or under: Web worksheet allows you to itemize your tax deductions for a given year. In most cases, your federal income tax will be less if you take. Web complete printable yearly itemized tax deduction worksheet online. Easily fill out pdf blank, edit, and. Web find the list of itemized deductions worksheet you require. If you and your spouse paid expenses jointly and are filing separate returns for 2016, see pub. Property taxes non cash contributions / donations medical &. $5,640 the limit on premiums is. After downloading the free template to your computer, you will automatically start on the first tab of the. $850 age 51 to 60: In most cases, your federal income tax will be less if you take. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. Web complete printable yearly itemized tax deduction worksheet online. • determine if a taxpayer should itemize deductions • determine the type of. Web your itemized deduction expenses must exceed: $1,690 age 61 to 70: Tax deductions for calendar year 2 0 ___ ___ marketing. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Use this worksheet to identify available deductions and tax. Web your itemized deduction expenses must exceed: Web age 40 or under: $4,520 age 71 and over: Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. If you and your spouse paid expenses jointly and are filing separate returns for 2016, see pub. Web the itemized deduction for state and local taxes and sales and property taxes is limited to a combined,. In most cases, your federal income tax will be less if you take. Web worksheet allows you to itemize your tax deductions for a given year. Property taxes non cash contributions / donations medical &. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web complete printable itemized deductions worksheet online with us legal forms. We will determine whether your total itemized deductions or the standard deduction for. Web find the list of itemized deductions worksheet you require. • determine if a taxpayer should itemize deductions • determine the type of. Web you can also deduct certain casualty and theft losses. Web use schedule a (form 1040) to figure your itemized deductions. Web how to use the itemized deductions checklist. $5,640 the limit on premiums is. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments,. Web how to use the itemized deductions checklist. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. At the end of this lesson, using your resource materials, you will be able to: $4,520 age 71 and over: $450 age 41 to 50: Web your itemized deduction expenses must exceed: Web find the list of itemized deductions worksheet you require. Use this worksheet to identify available deductions and tax. Easily fill out pdf blank, edit, and sign. (any one contribution of $250 or more needs written evidence) Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. $850 age 51 to 60: Web worksheet allows you to itemize your tax deductions for a given year. $5,640 the limit on premiums is.8 Best Images of Tax Itemized Deduction Worksheet IRS Form 1040

California Itemized Deductions Worksheet

Itemized Deductions Checklist Fill and Sign Printable Template Online

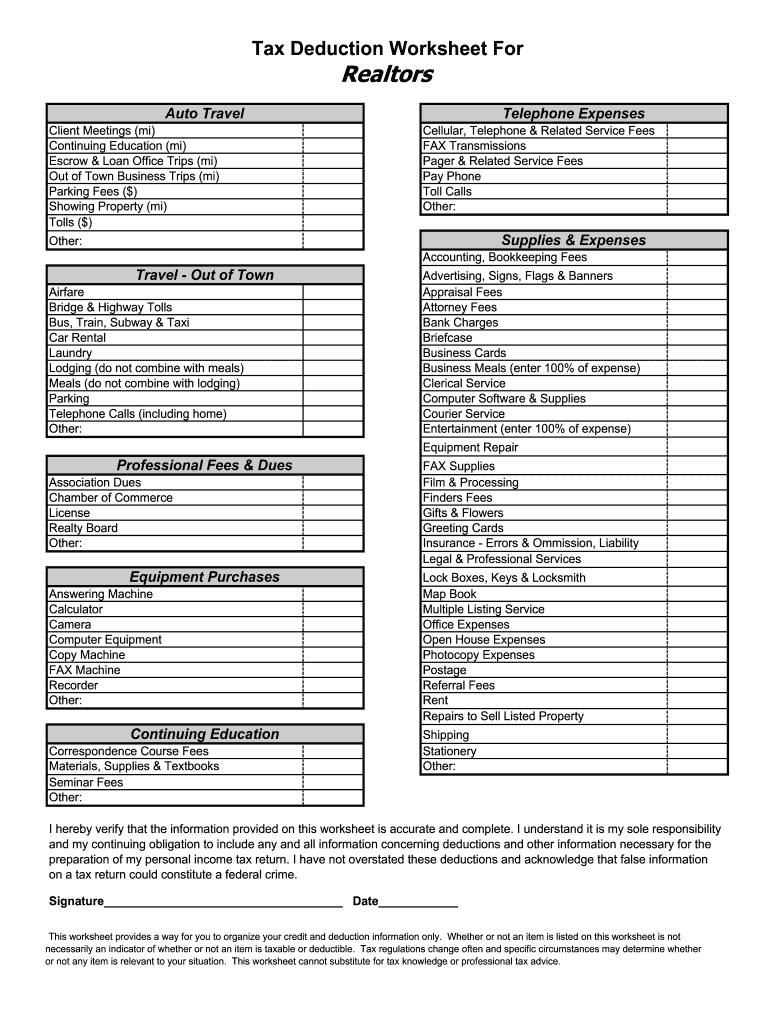

Haller Group AZ Tax Deduction Worksheet For Realtors Fill and Sign

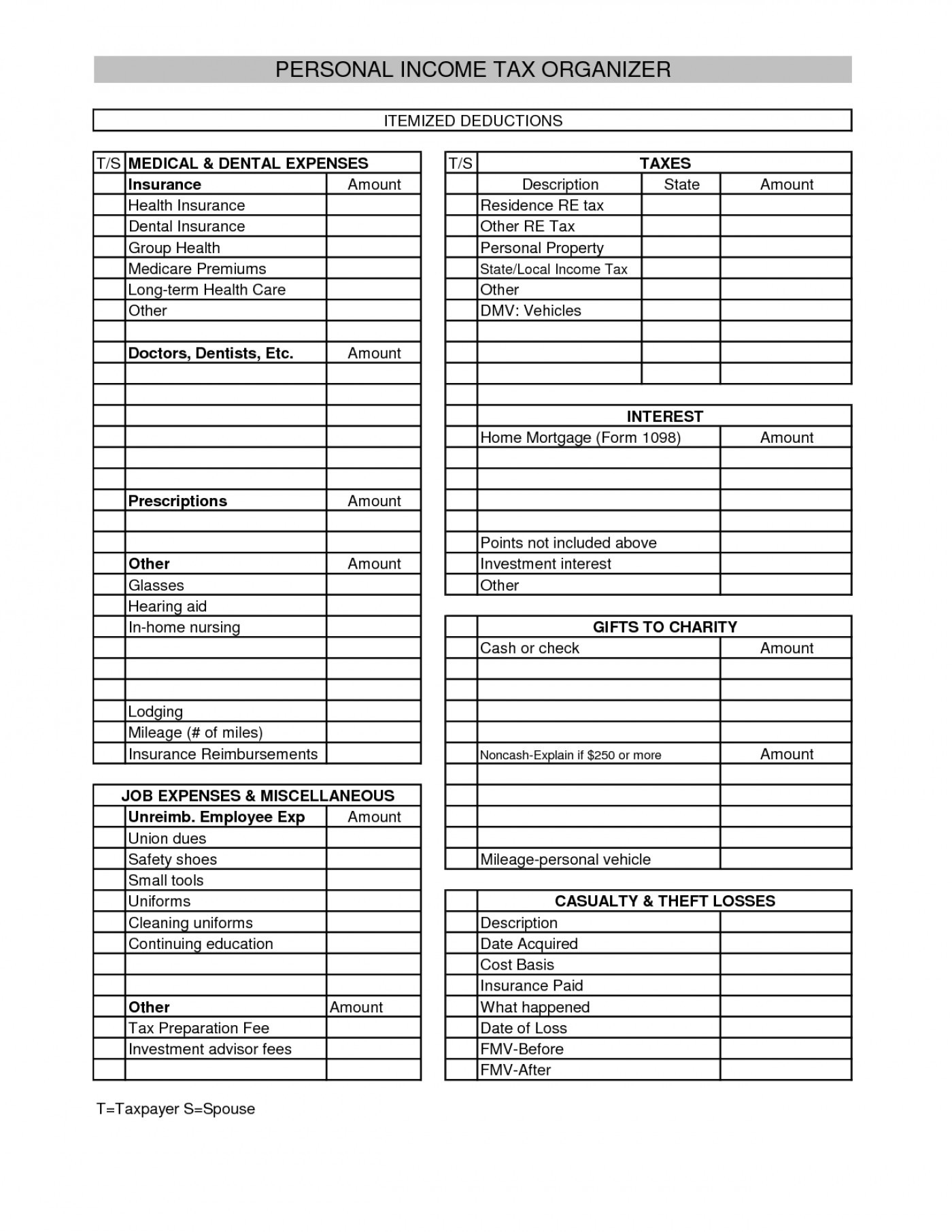

Itemized Deductions Worksheet 2018 Printable Worksheets and

5 Best Images of Itemized Tax Deduction Worksheet 1040 Forms Itemized

Itemized Deductions Worksheet —

Itemized Deduction Worksheet How Many Tax Allowances Should You Claim

Itemized Deductions Worksheet 2017 Printable Worksheets and

California Itemized Deductions Worksheet

Tax Deductions For Calendar Year 2 0 ___ ___ Marketing.

$1,690 Age 61 To 70:

Web This Schedule Is Used By Filers To Report Itemized Deductions.

Property Taxes Non Cash Contributions / Donations Medical &.

Related Post: