Schedule C Tax Form Printable

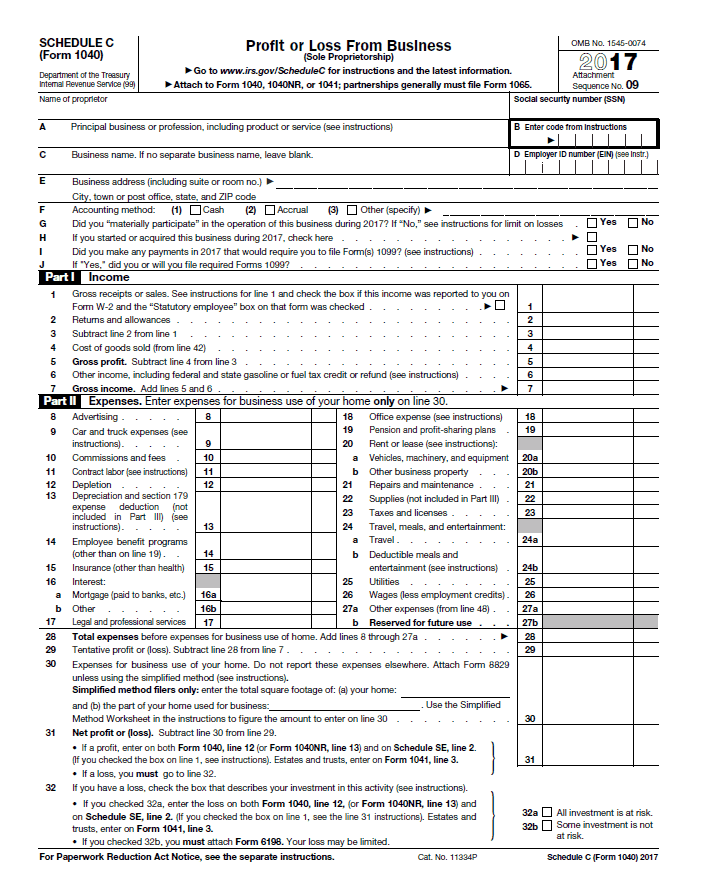

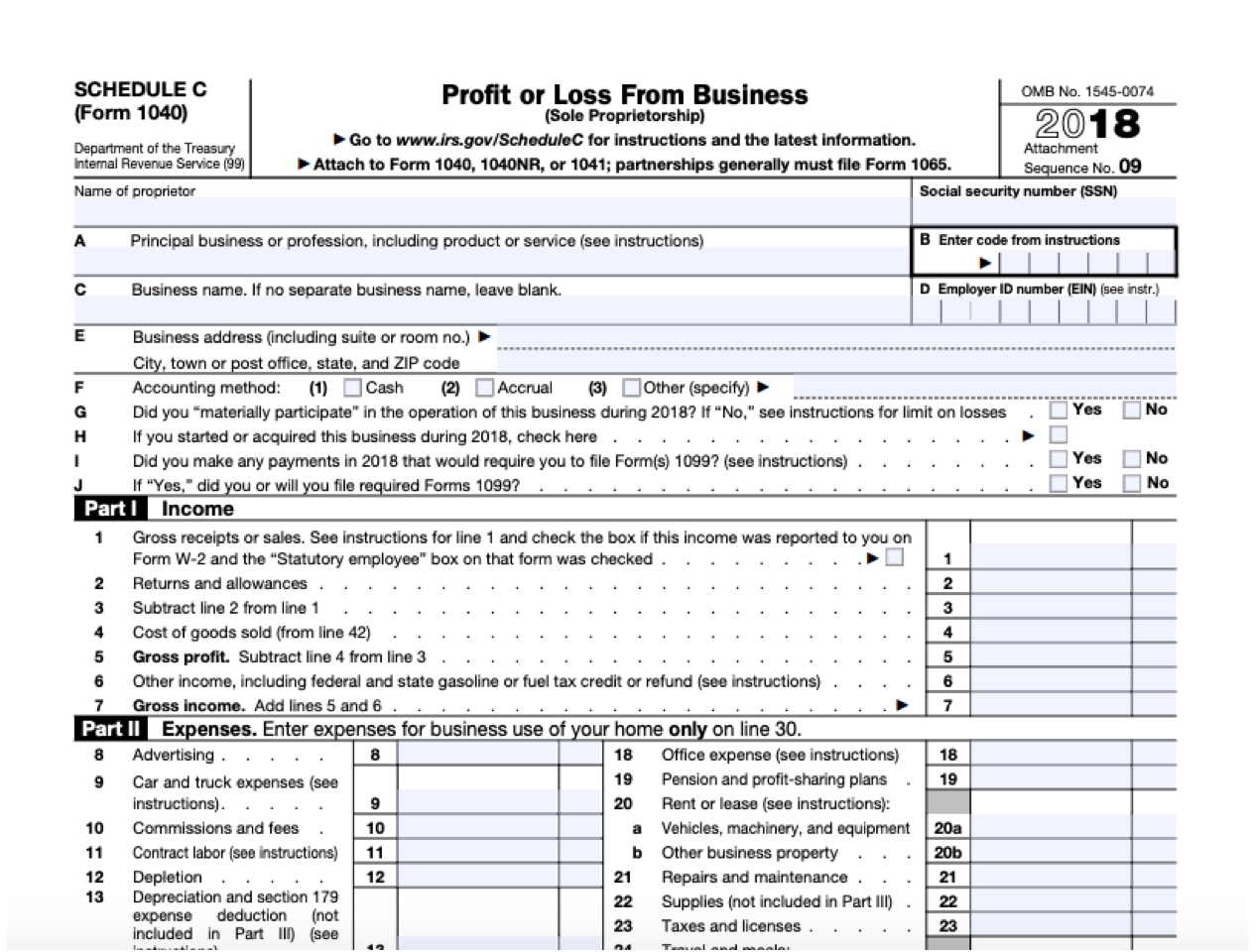

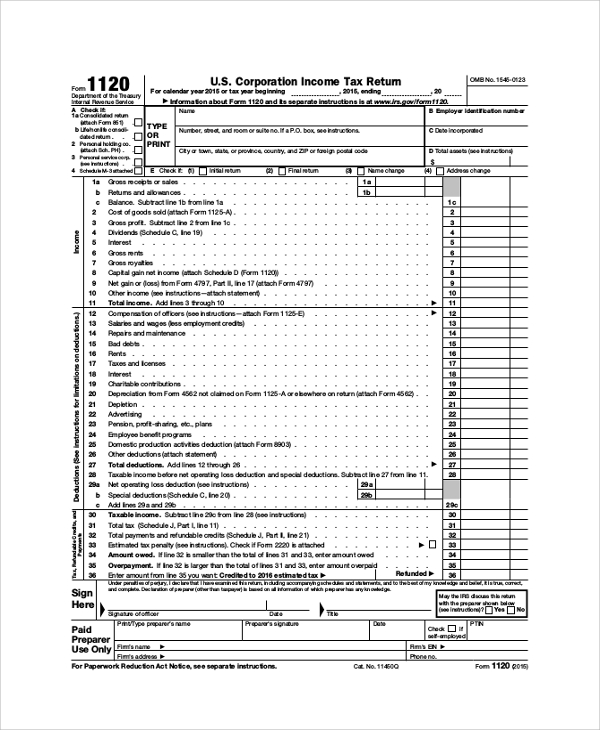

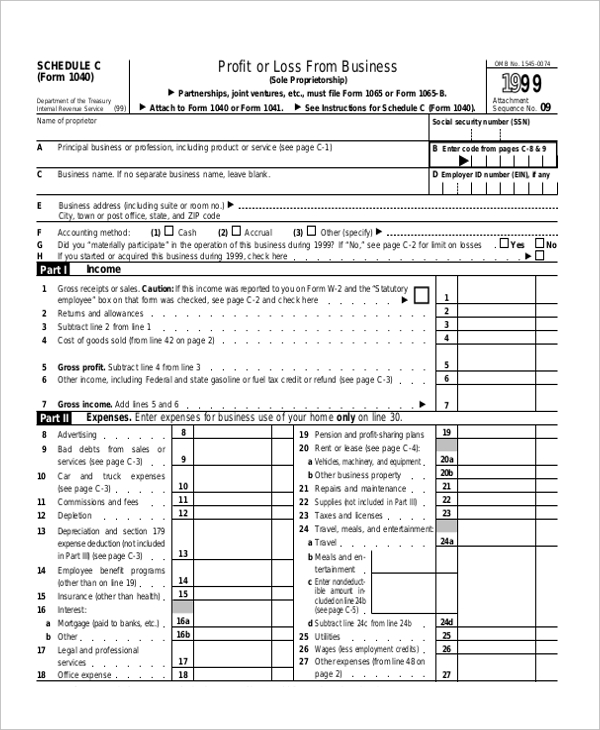

Schedule C Tax Form Printable - Who needs to fill out schedule c? Web in 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web irs schedule c is a tax form for reporting profit or loss from a business. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Web what is a schedule c? How many schedule c forms do you need? This document also known as. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. This document also known as. Web what is a schedule c? Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web irs schedule c, profit or loss from business, is. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web what is schedule c? Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from. Web a form schedule c: Web february 22, 2023. Web what is schedule c? Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each. You fill out schedule c at tax time and attach it to or file it. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web irs schedule c is a tax form for reporting profit or loss from a business. This document also known as. Web what is a schedule c? Web a form schedule c: You fill out schedule c at tax time and attach it to or file it. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. How many schedule. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web irs schedule c is a tax form for reporting profit or loss from a business. How many schedule c forms do you need? Who needs to fill out schedule c? Web a form schedule c: Who needs to fill out schedule c? Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each. You fill out schedule c at tax time and attach it to or. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. How many schedule c forms do you need? Web schedule c (form 1116) is used to identify foreign. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99). Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You. How many schedule c forms do you need? Sole proprietors have to prepare schedule c to report the income for the tax year and deductible expenses. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. You fill out schedule c at tax time and attach it to or file it. Web what is a schedule c? Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99). Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). This document also known as. Who needs to fill out schedule c? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each. Web in 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web february 22, 2023. Web what is schedule c? Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web a form schedule c: Web irs schedule c is a tax form for reporting profit or loss from a business. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Who needs to fill out schedule c? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web what is a schedule c? Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Sole proprietors have to prepare schedule c to report the income for the tax year and deductible expenses. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web february 22, 2023. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each. Web what is schedule c? Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99). Web a form schedule c: You fill out schedule c at tax time and attach it to or file it. This document also known as.It's Just Wrong Businesses Without Employees Qualify Too Alignable

IRS 1040 Schedule CEZ 20182022 Fill and Sign Printable Template

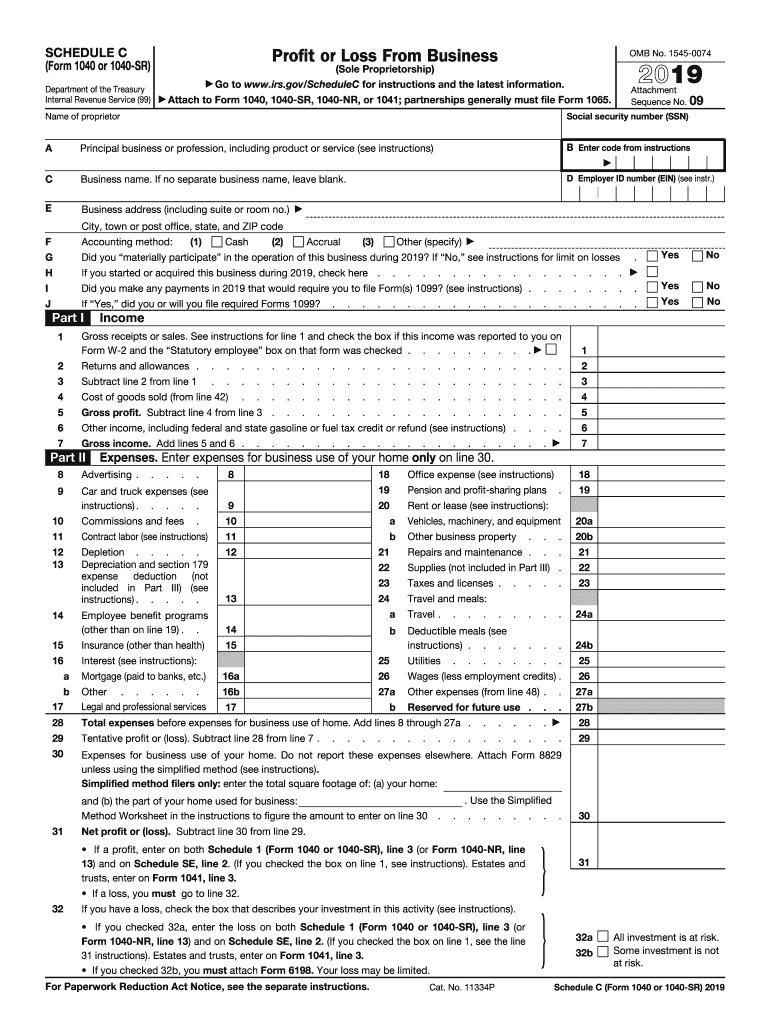

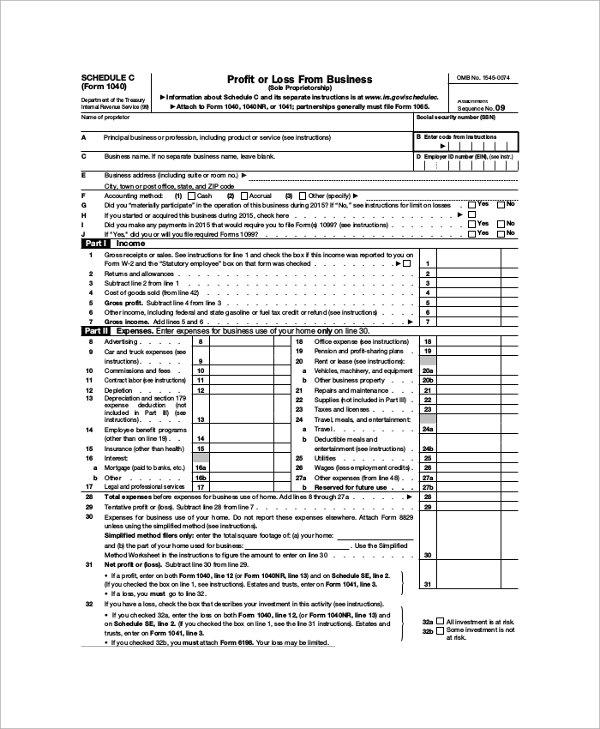

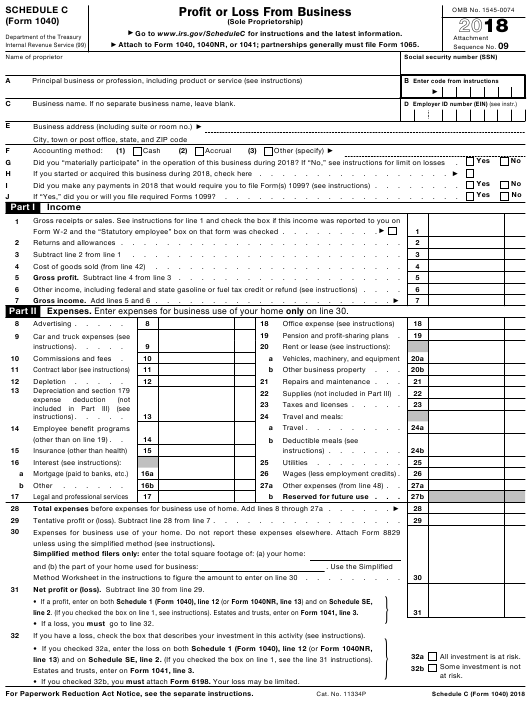

IRS 1040 Schedule C 2019 Fill and Sign Printable Template Online

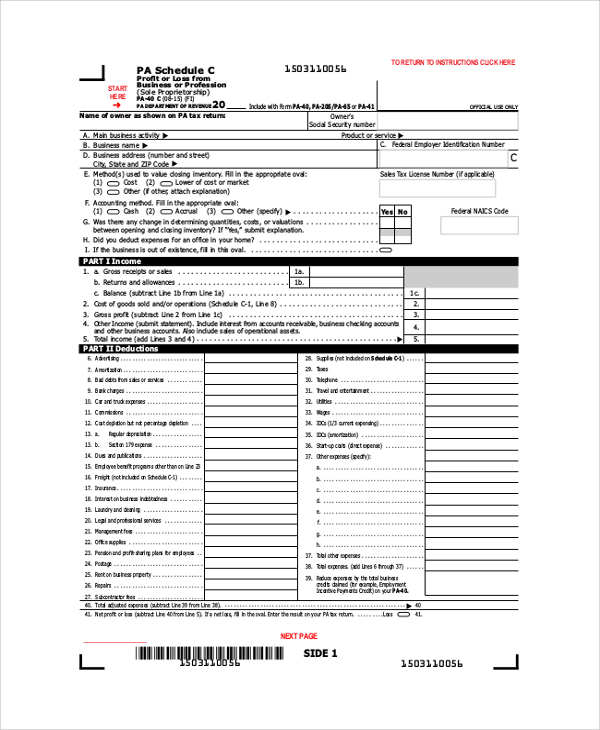

FREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

IRS Form 1040 Schedule C Download Fillable PDF Or Fill 2021 Tax Forms

Schedule C Form 1040 How to Complete it? The Usual Stuff

Free Printable Schedule C Tax Form Printable Form 2022

FREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service (99) Profit Or Loss From Business (Sole.

Web In 2023, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table.

How Many Schedule C Forms Do You Need?

Web Irs Schedule C Is A Tax Form For Reporting Profit Or Loss From A Business.

Related Post: