Tax Extension Form Printable

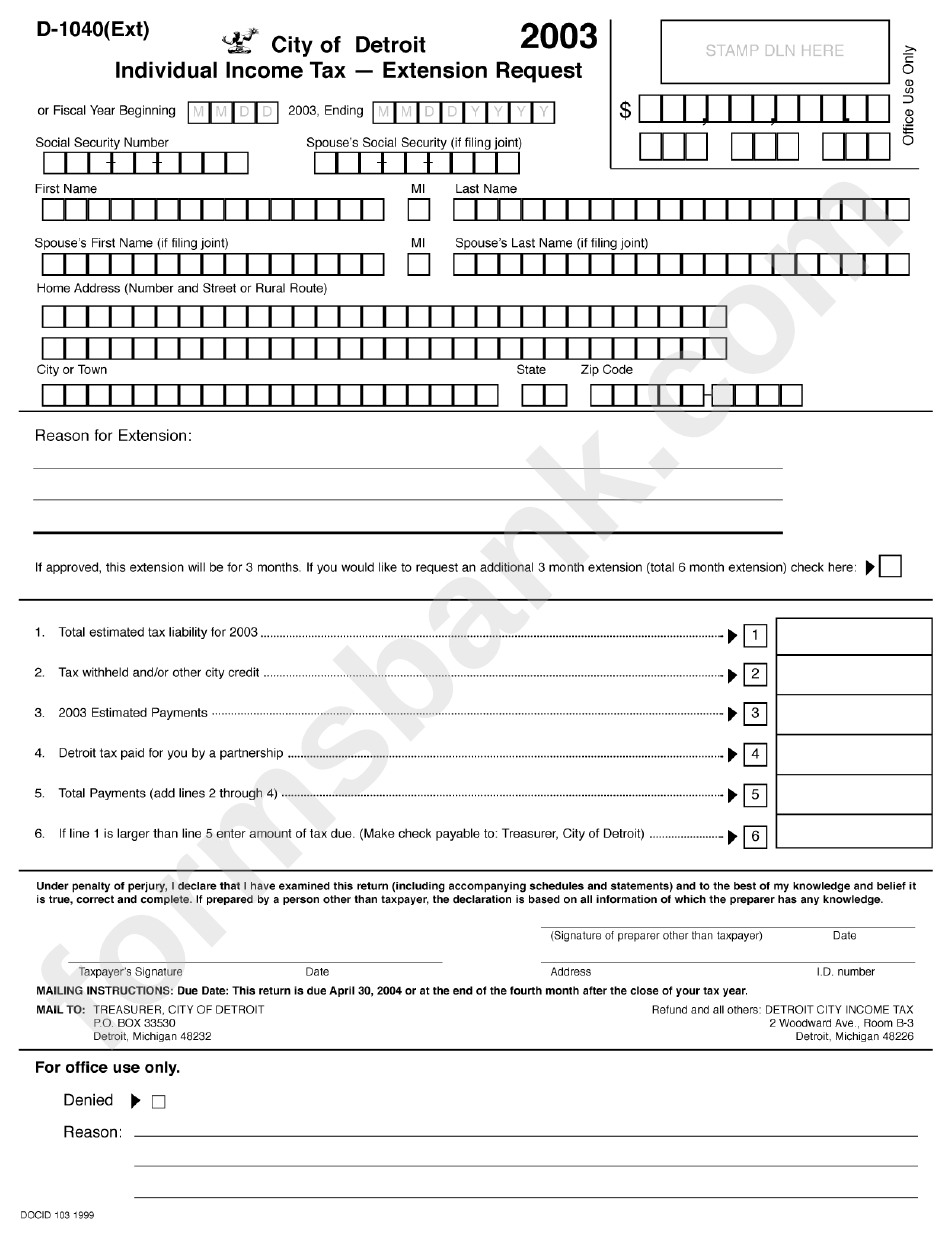

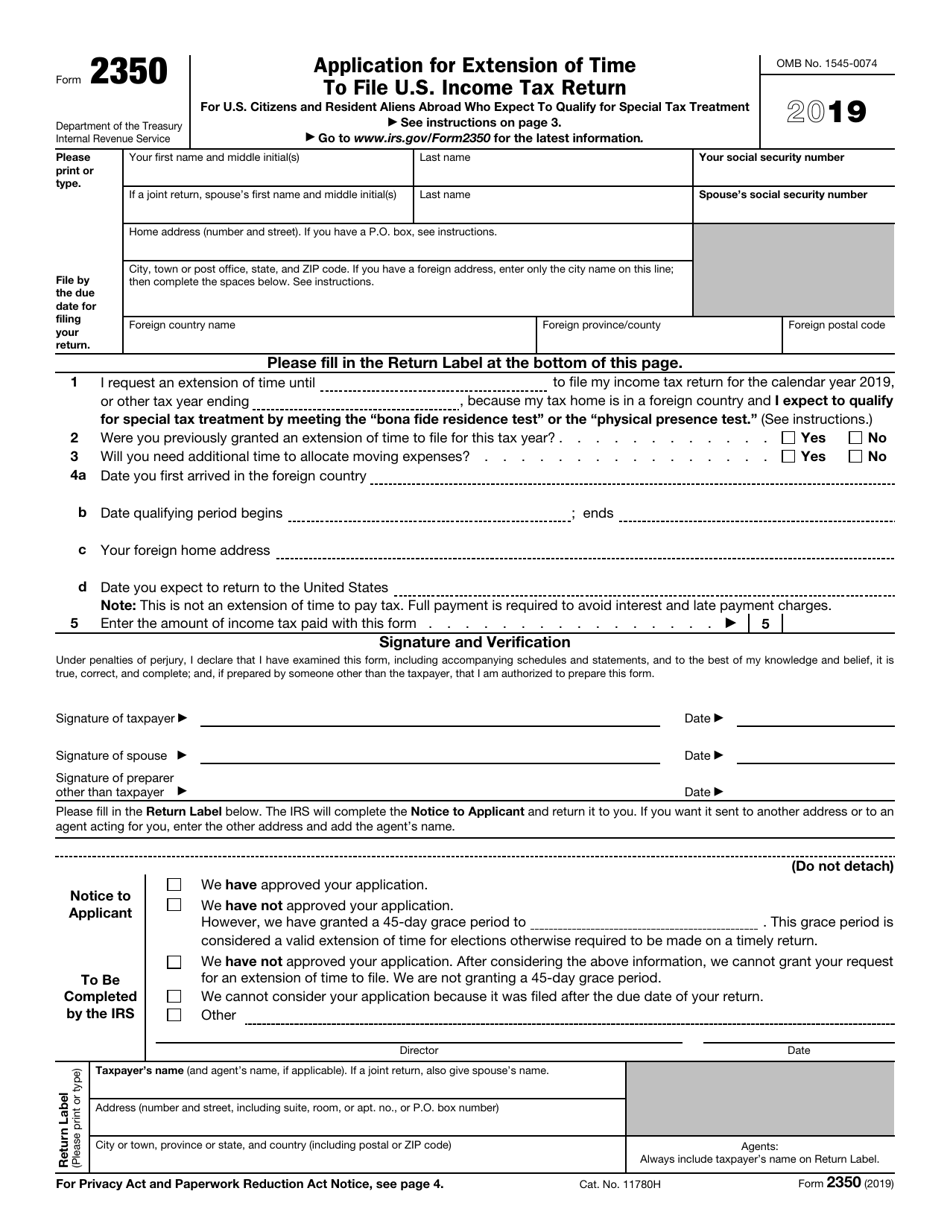

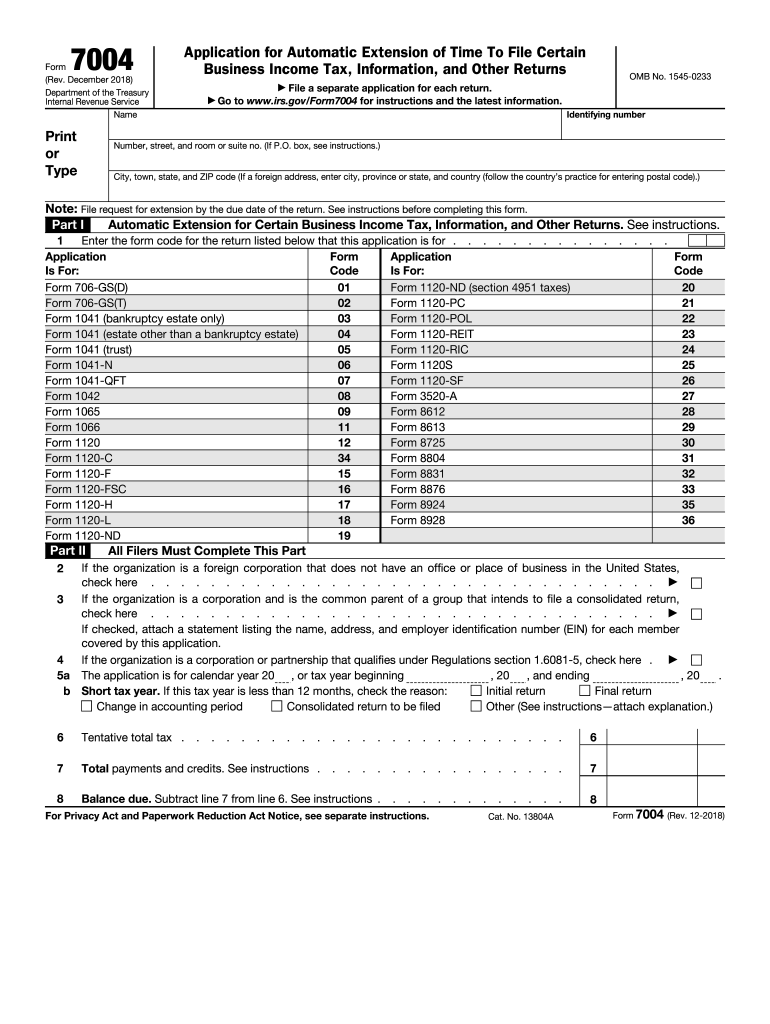

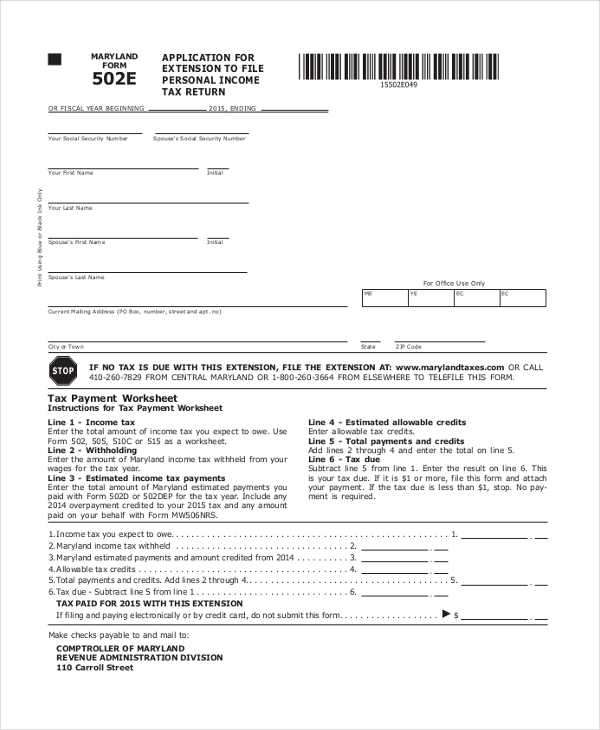

Tax Extension Form Printable - Web the new measure eliminates this disparity by raising the limit to $45,000 for both. Individuals can make an extension or estimated tax payment using tax preparation software. Web how to file an extension: Web general arts tax forms. (as before, the program’s rules. Web however, if you’re living and working overseas on the due date, you receive an automatic extension of two months. December 2018) department of the treasury internal revenue service. Web all individual tax filers, regardless of income, can electronically request an extension on form 4868 pdf by. Web an extension gives you until october 16, 2023, to file your 2022 federal income tax return. Web a tax extension is a request for additional time to file your federal income tax return with the irs. Web to get an automatic extension, fill out form 4868. Web we last updated federal form 4868 in december 2022 from the federal internal revenue service. Web how to file for an extension of state taxes while the irs requires you to file form 4868 for your federal extension, each. Web all individual tax filers, regardless of income, can electronically. Web this sample can be filled out and filed online, printed from a blank template, or downloaded from the irs website in a pdf or printable. Web application for automatic extension of time to file. Page one and two of the 2022 4868 form which includes both the payment instructions and mailing. Web all individual tax filers, regardless of income,. Web all you need to do is submit form 4868. Web this sample can be filled out and filed online, printed from a blank template, or downloaded from the irs website in a pdf or printable. You can use irs free file at irs.gov/freefile to. Web we last updated federal form 4868 in december 2022 from the federal internal revenue. You can use irs free file at irs.gov/freefile to. Web application for automatic extension of time to file. (as before, the program’s rules. This form is for income. Web all individual tax filers, regardless of income, can electronically request an extension on form 4868 pdf by. Web federal tax return extensions | usagov home taxes federal tax return extensions federal tax return extensions if. Individual tax filers, regardless of income, can use irs free file to. Web we last updated federal form 4868 in december 2022 from the federal internal revenue service. This form is for income. Web all you need to do is submit form. Web application for automatic extension of time to file. Web general arts tax forms. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete. Web a tax extension is a request for additional time to file your federal income tax return with the irs. Web all individual tax. Web this sample can be filled out and filed online, printed from a blank template, or downloaded from the irs website in a pdf or printable. Web you can get an automatic extension of time to file your tax return by filing form 4868 electronically. This form is for income. Web a tax extension is a request for additional time. Web federal tax return extensions | usagov home taxes federal tax return extensions federal tax return extensions if. Web the new measure eliminates this disparity by raising the limit to $45,000 for both. Web how to file for an extension of state taxes while the irs requires you to file form 4868 for your federal extension, each. Web all you. Web all you need to do is submit form 4868. Web this sample can be filled out and filed online, printed from a blank template, or downloaded from the irs website in a pdf or printable. Web how to file for an extension of state taxes while the irs requires you to file form 4868 for your federal extension, each.. Web if you're planning to file a tax extension this year, you'll need to submit form 4868 (pdf) to the irs either by paper. Web federal tax return extensions | usagov home taxes federal tax return extensions federal tax return extensions if. Individual tax filers, regardless of income, can use irs free file to. Web to get an automatic extension,. You can use irs free file at irs.gov/freefile to. Web if you're planning to file a tax extension this year, you'll need to submit form 4868 (pdf) to the irs either by paper. Web you can get an automatic extension of time to file your tax return by filing form 4868 electronically. Web all you need to do is submit form 4868. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete. Individuals can make an extension or estimated tax payment using tax preparation software. Web general arts tax forms. Web application for automatic extension of time to file. Web we last updated federal form 4868 in december 2022 from the federal internal revenue service. Web all individual tax filers, regardless of income, can electronically request an extension on form 4868 pdf by. Web the new measure eliminates this disparity by raising the limit to $45,000 for both. Individual tax filers, regardless of income, can use irs free file to. Web if you are a fiscal year taxpayer, you must file a paper form 2350. Web a tax extension is a request for additional time to file your federal income tax return with the irs. Web to get an automatic extension, fill out form 4868. Web how to file an extension: December 2018) department of the treasury internal revenue service. Page one and two of the 2022 4868 form which includes both the payment instructions and mailing. Web however, if you’re living and working overseas on the due date, you receive an automatic extension of two months. Web how to file for an extension of state taxes while the irs requires you to file form 4868 for your federal extension, each. Page one and two of the 2022 4868 form which includes both the payment instructions and mailing. Web federal tax return extensions | usagov home taxes federal tax return extensions federal tax return extensions if. Web an extension gives you until october 16, 2023, to file your 2022 federal income tax return. Web all you need to do is submit form 4868. This form is for income. Web how to file an extension: Web how to file for an extension of state taxes while the irs requires you to file form 4868 for your federal extension, each. Web this sample can be filled out and filed online, printed from a blank template, or downloaded from the irs website in a pdf or printable. Individuals can make an extension or estimated tax payment using tax preparation software. Web to get an automatic extension, fill out form 4868. Web if you are a fiscal year taxpayer, you must file a paper form 2350. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete. You can use irs free file at irs.gov/freefile to. Web if you're planning to file a tax extension this year, you'll need to submit form 4868 (pdf) to the irs either by paper. Web you can get an automatic extension of time to file your tax return by filing form 4868 electronically. Web application for automatic extension of time to file.Form D1040 Individual Tax Extension Request 2003 printable

Taxes 2016 extension form gasgram

Irs Fillable Extension Form Printable Forms Free Online

FREE 7+ Sample Federal Tax Forms in PDF

Irs Tax Forms Fill Out and Sign Printable PDF Template signNow

Irs Fillable Extension Form Printable Forms Free Online

tax extension form 2019 Fill Online, Printable, Fillable Blank irs

FREE 9+ Sample Federal Tax Forms in PDF MS Word

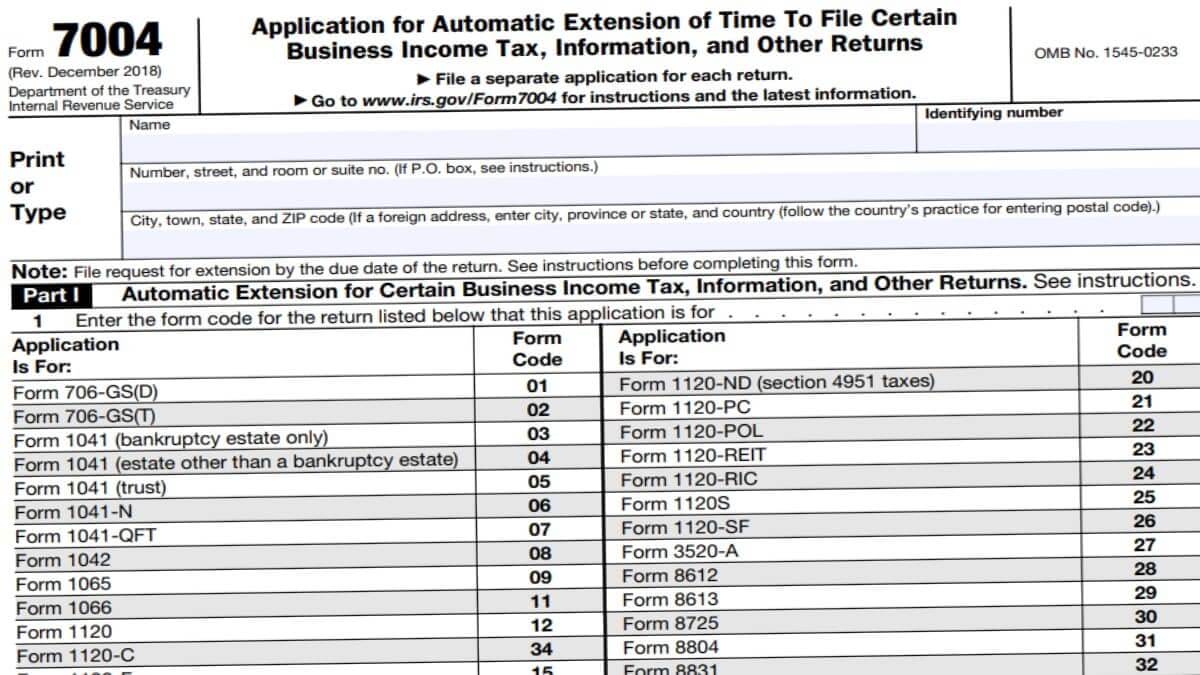

Business Tax Extension 7004 Form 2021

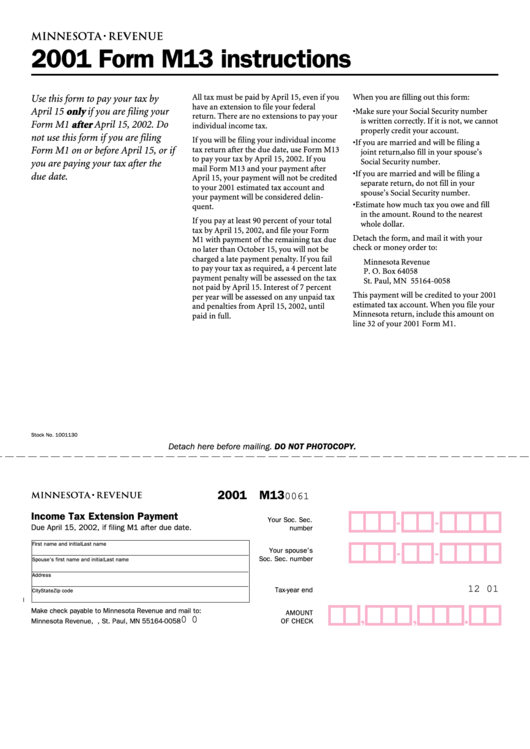

Form M13 Tax Extension Payment printable pdf download

Web All Individual Tax Filers, Regardless Of Income, Can Electronically Request An Extension On Form 4868 Pdf By.

(As Before, The Program’s Rules.

Web We Last Updated Federal Form 4868 In December 2022 From The Federal Internal Revenue Service.

Web However, If You’re Living And Working Overseas On The Due Date, You Receive An Automatic Extension Of Two Months.

Related Post: