Tax Form 8332 Printable

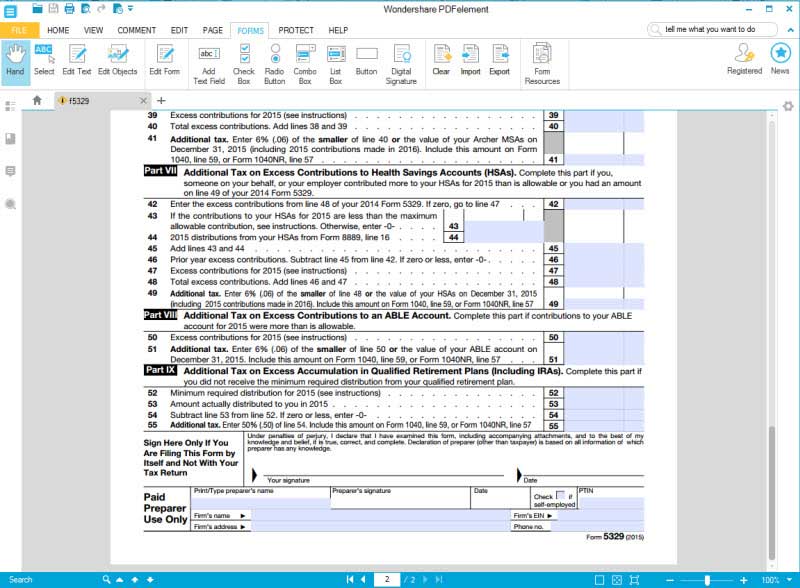

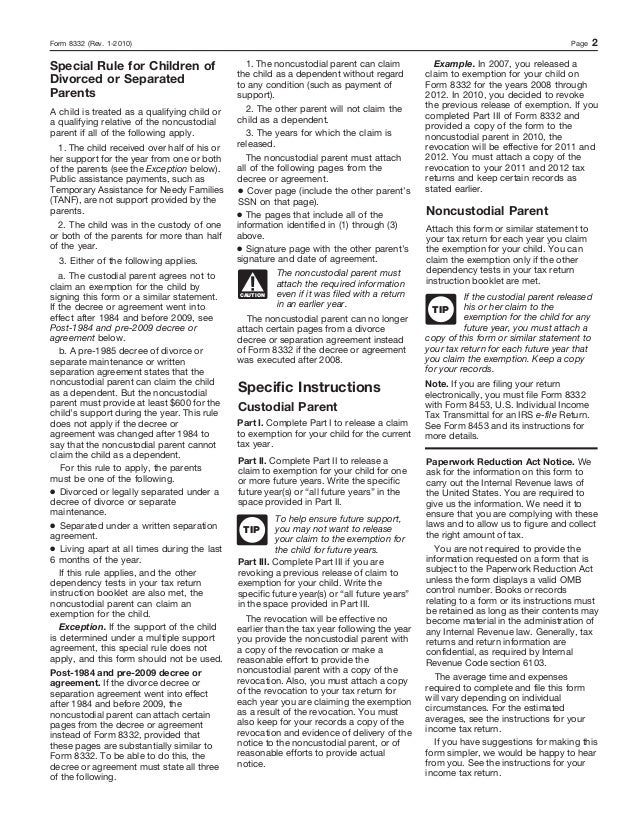

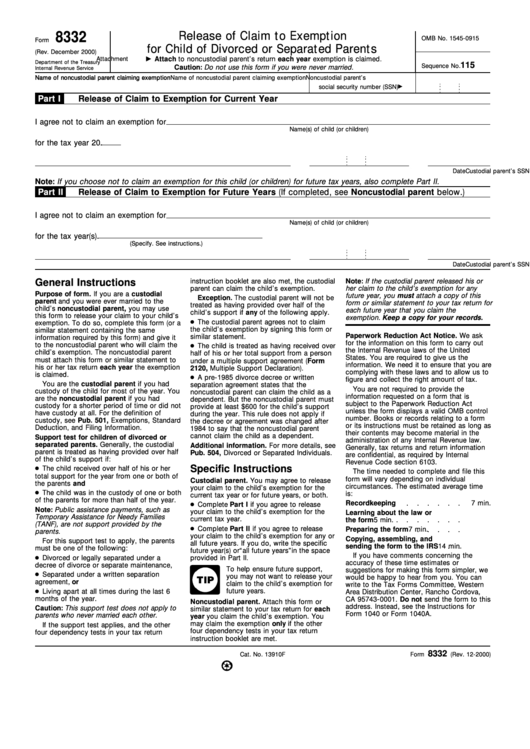

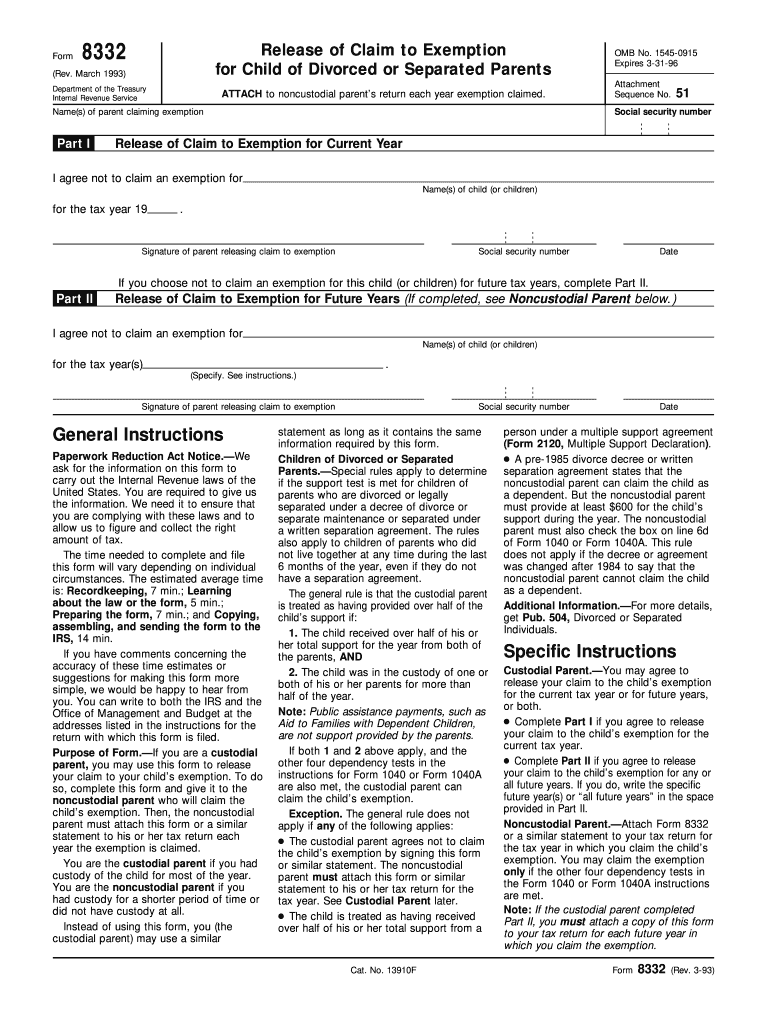

Tax Form 8332 Printable - Web when you print your return, form 8332 will print as a part of the return so you can sign the form and provide it to the noncustodial. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you are a custodial parent and you were ever married to the. Open or continue your return in turbotax if you aren't already in it; Web fill online, printable, fillable, blank form 8332: Top 12 things you must know about the new tax laws. Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. It lets a custodial parent allow another non. Web however, for tax years beginning after july 2, 2008, to properly waive the exemption in favor of the noncustodial parent for federal. Web fillable printable form 8332 what is a form 8332 ? Release/revocation of release of claim to (irs) form. Web brief introduction to the irs form 8332, with steps to withdraw or complete a claim to exemption for a child, who should do it,. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Web form 8332 is the. Release/revocation of release of claim to. A form 8332 is designed specially for the custodial parent who want to release the right of custody of. Web date general instructions purpose of form. Web the tax form 8332 printable is a short document that only takes up half a page. Web when you print your return, form 8332 will print as. October 2018) department of the treasury internal revenue service. It lets a custodial parent allow another non. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax. Open or continue your return in turbotax if you aren't already in it; Release/revocation of release of claim to exemption for child by custodial parent written by a. Web fillable printable form 8332 what is a form 8332 ? Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Get a fillable irs form 8332 template online. Web however, for tax years beginning after july 2, 2008, to properly waive the exemption in. If you are a custodial parent and you were ever married to the. Web brief introduction to the irs form 8332, with steps to withdraw or complete a claim to exemption for a child, who should do it,. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax. Web when you print your return, form. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax. Complete and sign it in seconds from your desktop or mobile device, anytime and. Web what is form 8332: Web brief introduction to the irs form 8332, with steps to withdraw or complete a claim to exemption for a child, who should do it,. Web. Get a fillable irs form 8332 template online. Web the tax form 8332 printable is a short document that only takes up half a page. If you are a custodial parent and you were ever married to the. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this.. Web if you are filing your return electronically, you must file form 8332 with form 8453, u.s. If you are a custodial parent and you were ever married to the. It lets a custodial parent allow another non. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this.. Open or continue your return in turbotax if you aren't already in it; Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this. Web however, for tax years beginning after july 2, 2008, to properly waive the exemption in favor of the noncustodial parent for federal. October 2018). Release/revocation of release of claim to. Web however, for tax years beginning after july 2, 2008, to properly waive the exemption in favor of the noncustodial parent for federal. Web date general instructions purpose of form. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Get a. Open or continue your return in turbotax if you aren't already in it; How do you use form 8332? Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. If releasing the right to claim your child as a. Web if you are filing your return electronically, you must file form 8332 with form 8453, u.s. Release/revocation of release of claim to (irs) form. October 2018) department of the treasury internal revenue service. Web when you print your return, form 8332 will print as a part of the return so you can sign the form and provide it to the noncustodial. Web the tax form 8332 printable is a short document that only takes up half a page. If you are a custodial parent and you were ever married to the. Web however, for tax years beginning after july 2, 2008, to properly waive the exemption in favor of the noncustodial parent for federal. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Complete and sign it in seconds from your desktop or mobile device, anytime and. Web brief introduction to the irs form 8332, with steps to withdraw or complete a claim to exemption for a child, who should do it,. Web complete the 8332, filling in all applicable sections. Web what is form 8332: Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this. Web fillable printable form 8332 what is a form 8332 ? Get a fillable irs form 8332 template online. Web to find and fill out form 8332: Release/revocation of release of claim to. Web fill online, printable, fillable, blank form 8332: A form 8332 is designed specially for the custodial parent who want to release the right of custody of. Open or continue your return in turbotax if you aren't already in it; If you are a custodial parent and you were ever married to the. Web when you print your return, form 8332 will print as a part of the return so you can sign the form and provide it to the noncustodial. Web we last updated the release/revocation of release of claim to exemption for child by custodial parent in february 2023, so this. Web the tax form 8332 printable is a short document that only takes up half a page. October 2018) department of the treasury internal revenue service. It lets a custodial parent allow another non. Release/revocation of release of claim to (irs) form. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Complete and sign it in seconds from your desktop or mobile device, anytime and. Web however, for tax years beginning after july 2, 2008, to properly waive the exemption in favor of the noncustodial parent for federal. Web irs form 8332 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 110 votes how to fill out and sign irs form 8332 printable. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent.Form 8332 Edit, Fill, Sign Online Handypdf

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

Tax Form 8332 Printable Master of Documents

Is IRS tax form 8332 available online for printing? mccnsulting.web

Printable Irs Forms 2021 8332 Calendar Printable Free

IRS Form 8332

Tax Form 8332 Printable 2021 Printable Form 2022

Fillable Form 8332 Release Of Claim To Exemption For Child Of

Is IRS tax form 8332 available online for printing? mccnsulting.web

Tax Form 8332 Printable Master of Documents

Web Fillable Printable Form 8332 What Is A Form 8332 ?

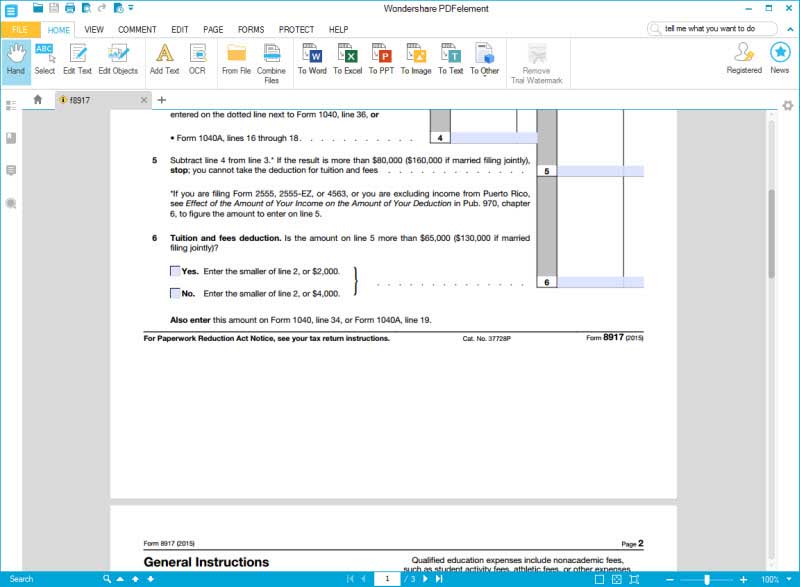

Edit Your Form 8332 Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

How Do You Use Form 8332?

Web Brief Introduction To The Irs Form 8332, With Steps To Withdraw Or Complete A Claim To Exemption For A Child, Who Should Do It,.

Related Post: